The State of The Luxury Market Africa 2025

The Eighth Annual Report by Luxity

The 2025 edition of The State of The Luxury Market Africa marks Luxity’s eighth exploration into Africa’s evolving luxury landscape. This year’s report reveals how South Africa’s luxury shoppers are buying smarter, not smaller — balancing indulgence with investment. Drawing from Luxity’s sales data, search metrics, and resale analytics, it delivers a definitive snapshot of what’s next for luxury in Africa.

Past Editions:

Luxity’s State of The Luxury Market Africa —

[2024]

[2023]

[2022]

[2021]

[2020]

[2019]

[2018]

Smarter Luxury in 2025

In 2025, South Africa’s luxury consumers aren’t scaling back — they’re scaling up in intent.

The trend: fewer but finer purchases. Shoppers shifted toward bags, jewellery, and timepieces — categories proven to hold long-term value.

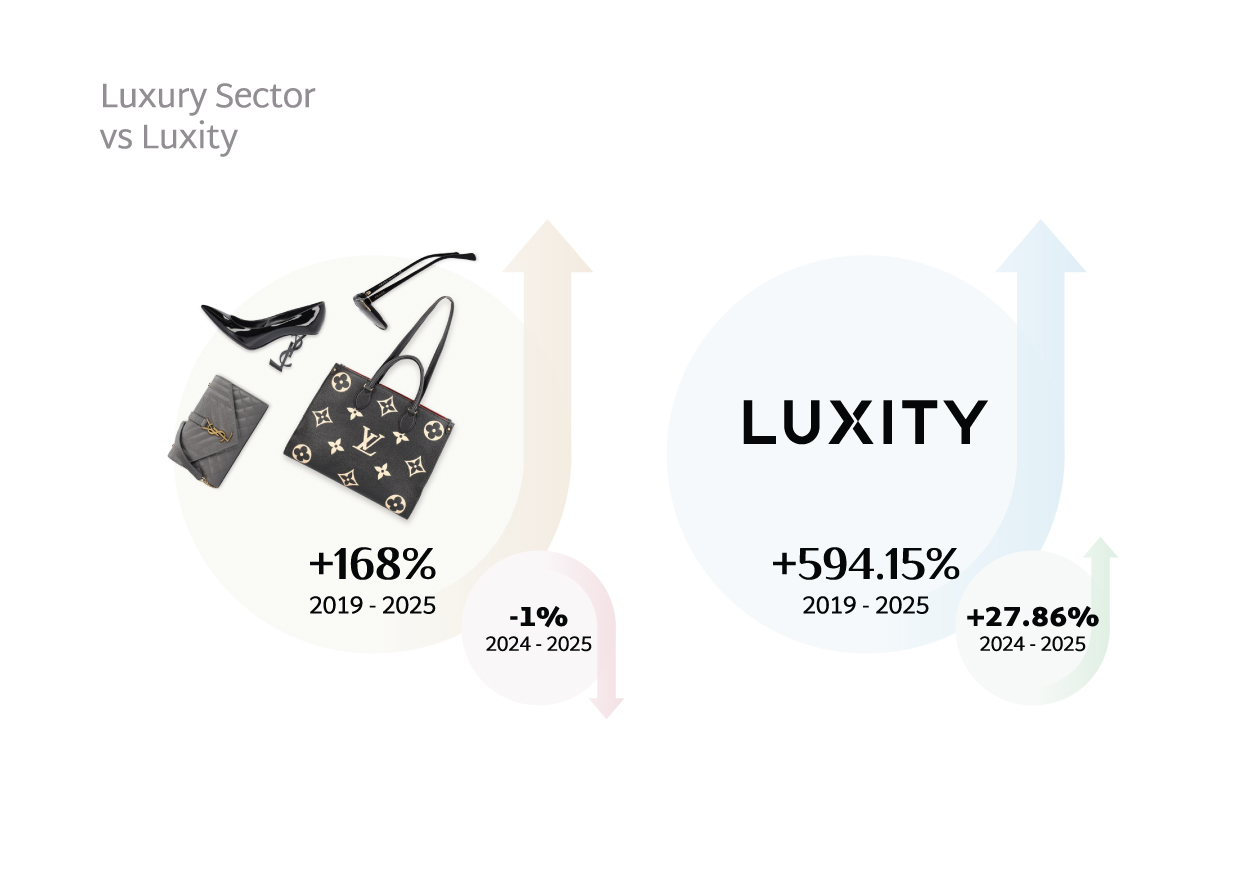

Luxury retail growth: –1% YoY (Clur Shopping Index)

Luxity growth: +27.86% YoY — marking 594.15% growth since 2019

Pre-owned luxury is no longer an alternative — it’s the intelligent choice for those who value both prestige and practicality.

The Shift: From Flash to Forever

Luxury is no longer about owning more; it’s about owning meaningfully.

In 2025, South Africans embraced “forever pieces” that merge craftsmanship, rarity, and resale potential.

Jewellery searches rose by 43.8%, while bag searches grew 14.6%.

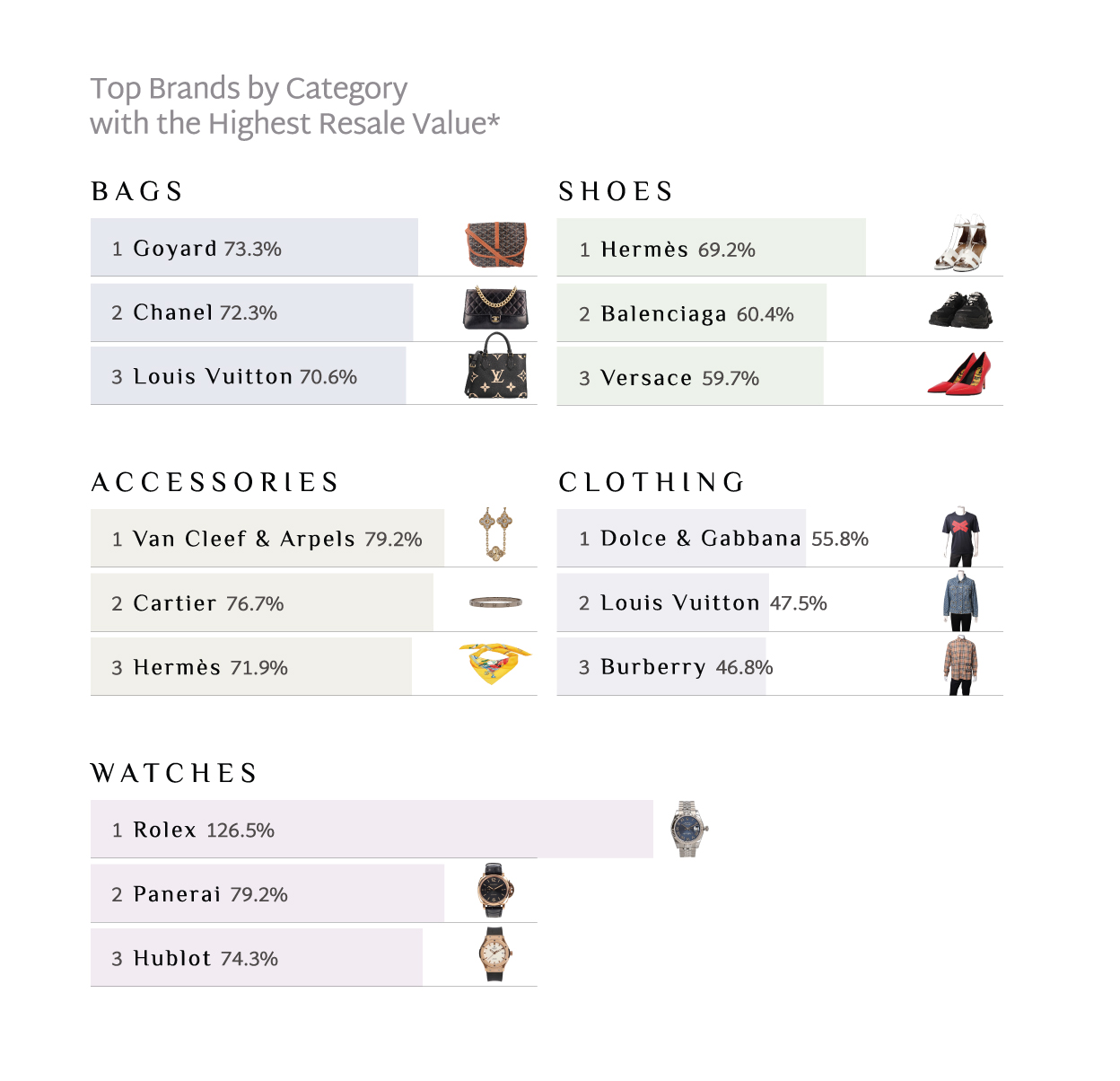

Rolex achieved a record resale at 126.5% of retail price, solidifying watches as Africa’s most stable luxury asset class.

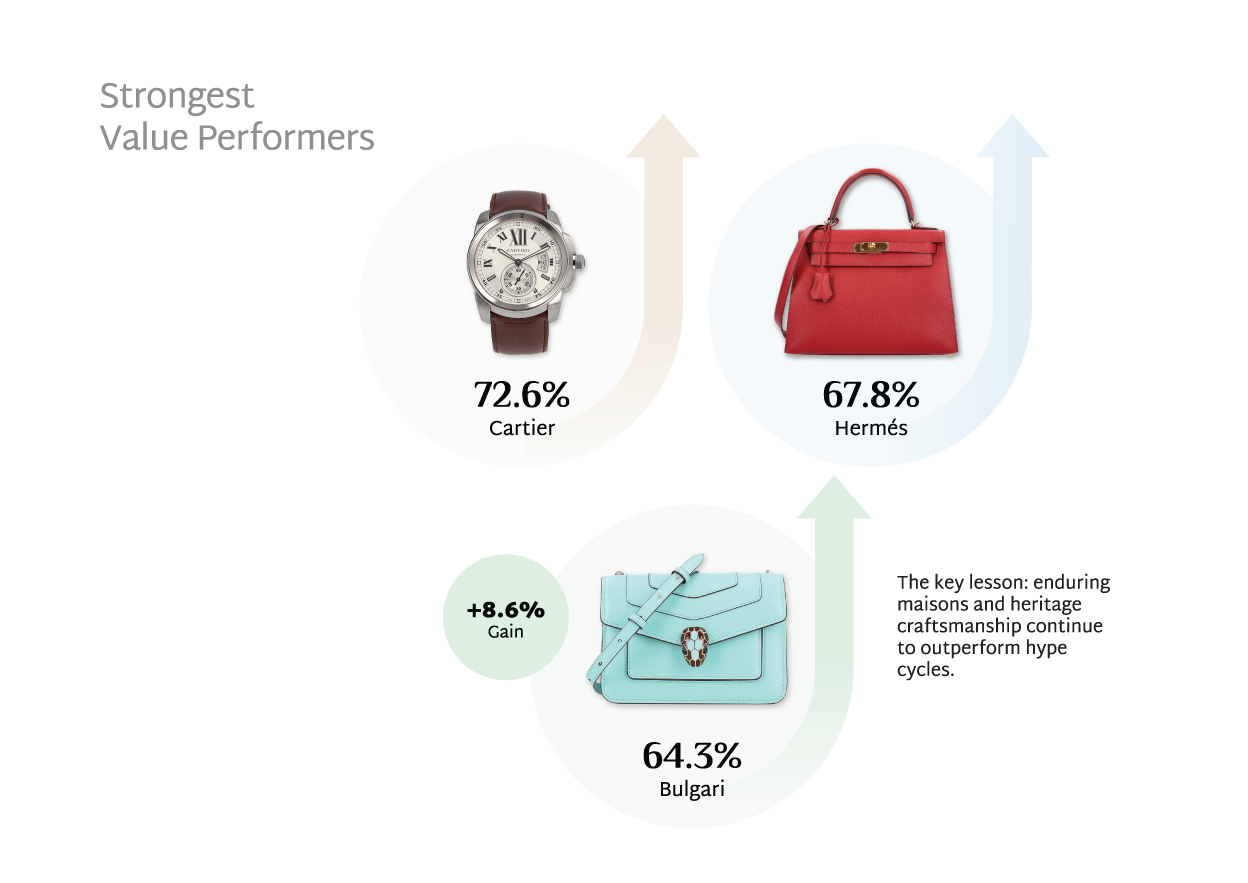

Brands such as Cartier, Hermès, and Bulgari also surged — proving that timeless craftsmanship outlasts passing trends.

The Rise of the Rational Collector

Gone are impulse buys and fleeting trends.

In 2025, South Africans evolved into rational collectors — curators of luxury assets that appreciate over time. Each purchase now carries dual value: emotional connection and investment return. The modern collector asks not only “How does it look?” but “How does it hold value?”

The Expanding Luxury Landscape

For the first time, brand discovery diversified notably.

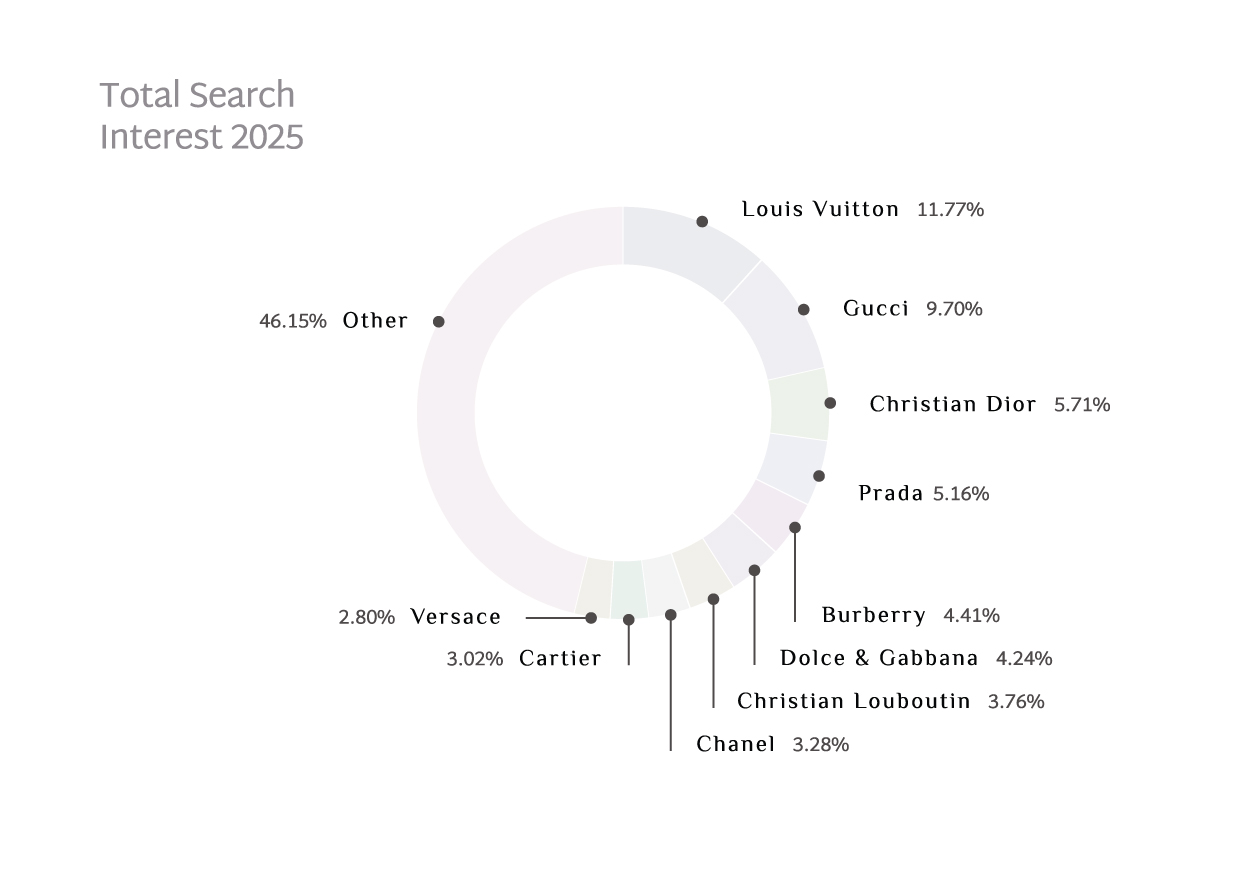

Louis Vuitton and Gucci, while still leading, saw their combined search share fall from 30% to 21%.

Emerging names such as Bulgari, Givenchy, and Montblanc gained traction, showing that loyalty today is informed, not blind.

Luxury loyalty is no longer blind; it’s informed, intentional, and evolving.

2025’s Strongest Value Performers

South Africa’s most resilient luxury brands in resale value:

The data reinforces a long-held truth: classic craftsmanship consistently outperforms fleeting fashion.

Search Insights: What South Africans Want

Search trends reveal where curiosity — and spending power — lie.

Top 10 Most Searched Luxury Brands (2025):

The top 10 brands made up 53.85% of total search share, down from 61.7% in 2024 — proof of expanding taste and exploration. etite for niche luxury houses.

Category Winners: Where Value Lives

Consumers in 2025 leaned toward lasting categories over fast fashion turnover:

The takeaway? Consumers are seeking tangible luxury — items that retain both beauty and resale power.

Top Resale Performers by Category

Popularity vs. Value: The Great Divide

Data reveals a fascinating truth:

Popularity doesn’t always equal profitability.

Correlation between brand awareness and resale value sits at just 0.30, proving that visibility ≠ value.

While brands like Prada and Burberry remain top of mind, Bulgari and Givenchy consistently outperform in resale strength.

Smart collectors invest in value, not virality.

Chanel vs. Gold: The Unexpected Investment

When it comes to stability, the Chanel Classic Flap Bag rivals even gold.

While global markets fluctuate, a well-kept Flap Bag retains over 64% of its retail value, outpacing many short-term commodity gains.

“In 2025, the smartest investment wasn’t bullion, it was the bag.”

The Crown of Luxury Brands: 2025 Leaders

Rolex — 126.5% resale value, reaffirming its dominance as the world’s most reliable luxury investment.

Cartier — the everyday anchor of prestige, heritage, and liquidity.

Van Cleef & Arpels — the quiet powerhouse of timeless desirability.

On the fashion front, Hermès, Chanel, and Louis Vuitton continue to define the pinnacle of value retention and cultural permanence.

Outlook: 2026 and Beyond

As we approach 2026, Africa’s luxury market stands stronger than ever — refined, data-driven, and deeply discerning.

Luxury in Africa is no longer about excess; it’s about intentional excellence.

Resale is no longer the alternative to retail — it’s the evolution of luxury itself.

Download the Full Report

Access in-depth insights, brand rankings, and data tables in The State of The Luxury Market Africa 2025 report by Luxity.

Related Posts

Haute & Haunted: The Luxity Halloween Edit You’ll Actually Want to Wear

The 5 Street Style Trends Defining Paris Fashion Week — and How to Shop Them at Luxity