State of the Luxury Market in Africa 2023

Welcome to the sixth edition of The State of The Luxury Market Africa Report by Luxity, Africa’s premier pre-owned luxury reseller. This annual compendium reflects upon the dynamics, preferences, and trajectories within the luxury sector of the continent, with a pronounced emphasis on South Africa. Employing a robust combination of search metrics, traffic data, sales statistics, and additional external indicators, we strive to provide a comprehensive understanding of the luxury landscape in Africa.

Past Editions:

Luxity’s State of The Luxury Market Africa 2022

Luxity’s State of The Luxury Market Africa 2021

Luxity’s State of The Luxury Market Africa 2020

Luxity’s State of The Luxury Market Africa 2019

Luxity’s State of The Luxury Market Africa 2018

2023 emerges at the nexus of economic challenges and socio-cultural shifts. As we navigate a year significantly marred by higher inflation, a decelerating economy, and a weakening rand, the affordability quotient for luxury experiences an undeniable dip. The fervour of ‘revenge spending’ post the COVID-19 pandemic saw an uptick in luxury demand, but the pertinent question lingers: Will this demand surge persist, eclipsing supply, or will we observe a moderation as consumers recalibrate to the evolving economic paradigm and their new reality?

In the subsequent sections, we delve deep into these trends, examining the subtle and overt nuances that define the luxury sector in 2023.

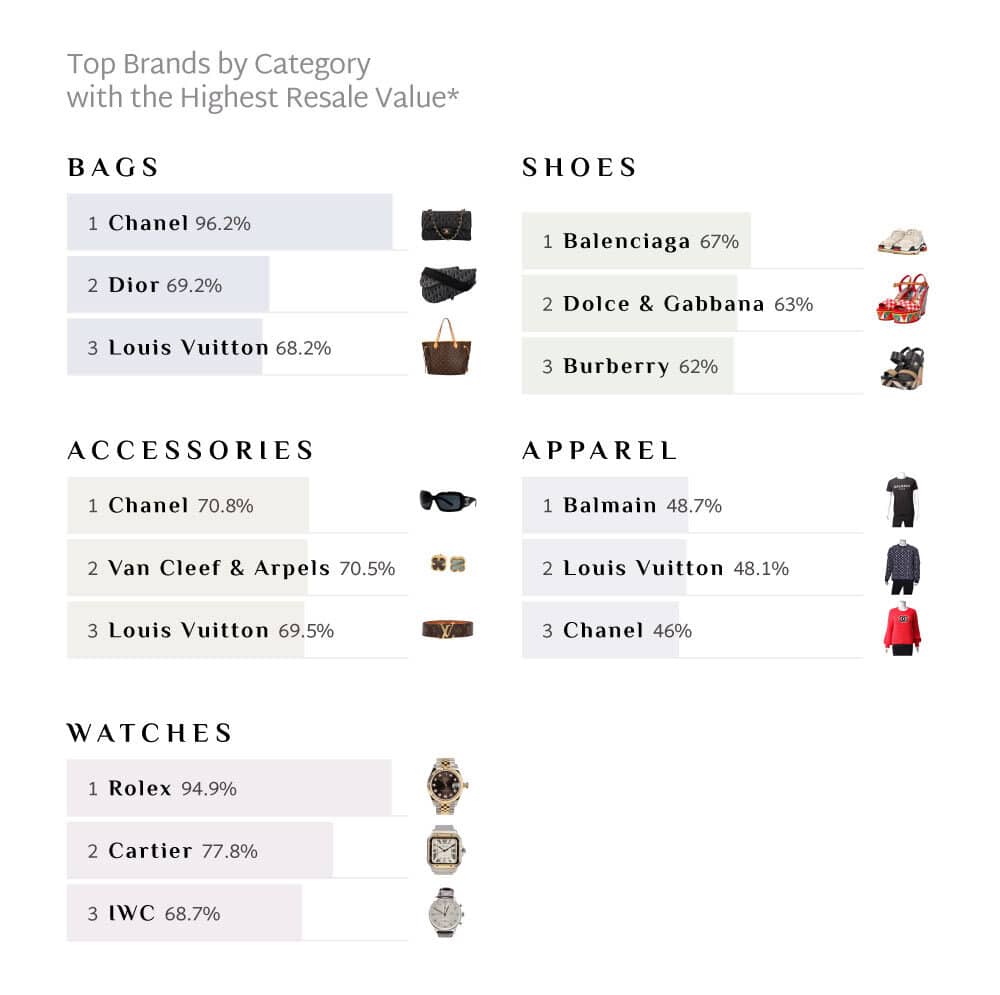

Value of Luxury Brands

In evaluating the prestige and allure of luxury brands, resale values provide significant insights. These values, juxtaposed against the percentage of the original price, encapsulate the enduring clout and resilience of brands in the market.

The luxury landscape of 2023 has unravelled a few intriguing observations:

- Louis Vuitton and Chanel, traditionally formidable players, experienced a mild shakeup this year. Their resale values declined by 1.9% and 0.9% respectively. While such a shift might appear subtle on the surface, this could signify the market’s inability to keep up with the brisk pace of price increases—a phenomenon particularly pronounced in these two brands.

- Balenciaga stood as a beacon of resilience, especially in the South African market. The brand recorded a robust 10.1% escalation in resale value. Internationally, Balenciaga grappled with diminished desirability, a fallout from its contentious advertising campaigns in 2022. However, on local shores, it appeared invulnerable to such sentiments, underscoring the unique dynamics of the African luxury market.

Taken collectively, the year witnessed an amalgamation of trends—some brands

consolidating their positions, some retracing, and others breaking new ground. It’s noteworthy that after years of consistent growth across the board, 2023 charted a nuanced market trajectory.

An enriching addition to this year’s analysis has been the integration of the watch and jewellery categories and brands. This has been revelatory:

- Rolex and Cartier reigned supreme, flaunting enviable resale values of 97.6% and 74.6% respectively. These numbers, largely driven by their iconic watch and jewellery collections, enshrine their perpetual magnetism.

- Tag Heuer, with a resale value of 58.8%, provided an instructive contrast. While it trails significantly behind Rolex and Cartier, its positioning among the top 15 accentuates an essential point: In the realm of luxury, it’s not just the category (in this case, luxury watches) that dictates a brand’s resale potency but also the intrinsic brand value itself. Tag Heuer’s relatively lower figures underscore that the brand’s impact within the luxury watch segment is not as dominant as its high-flying counterparts.

In summation, the luxury sector’s allure, while perennial, undergoes intricate shifts influenced by brand decisions, global events, and inherent market dynamics.

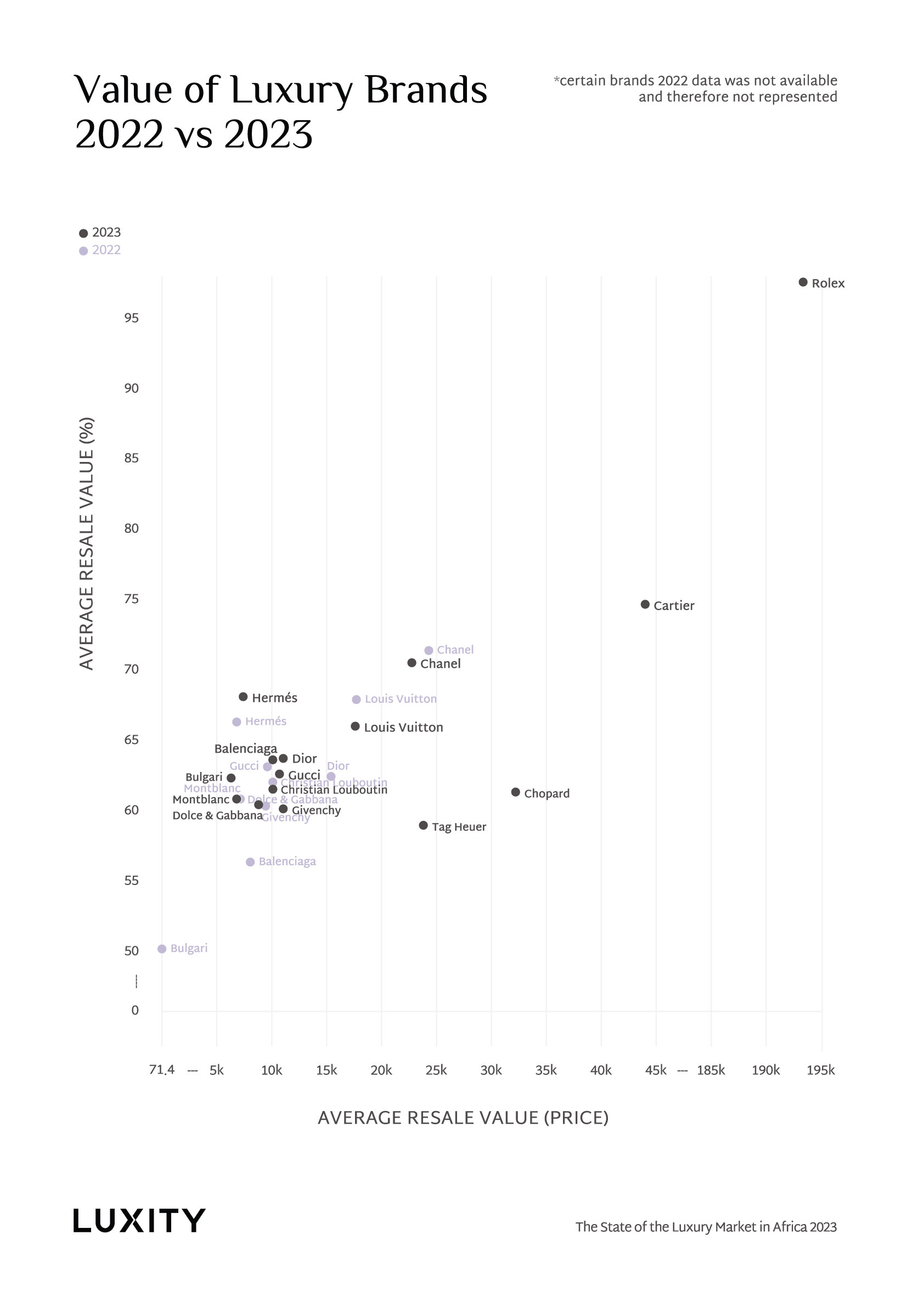

Search Interest

Search interest, a metric representing the number of searches within an online store, is a critical measure of brand awareness and desirability. This component, segmented by individual brands, gives us an insight into the pulse of consumer curiosity and potentially, intent.

The search interest for 2023 offers a tableau reflective of entrenched brand hierarchies, but with a few twists:

- Louis Vuitton and Gucci once again emerged as the crown jewels of search interest, commanding 16.88% and 14.14% respectively. Together, they constitute roughly 1 in 3 searches (31.02%), albeit marginally attenuated from the previous year’s 32.3%. The digital footfall underscores these brands’ voluminous presence: they dominate not only in search curiosity but also in transactional metrics, leading in both purchases and sales on the platform.

- The subsequent eight brands in the pecking order collectively claim roughly the next 1 in 3 searches, while the rest of the brands fill the final third. This distribution underscores the concentration of brand power, with a select few capturing a significant share of the digital curiosity.

Yet, the landscape becomes intriguing when we adjust the search interest vis-à-vis available items in the market. Naturally, supply might drive demand, and by accounting for this factor, we attempt to isolate the intrinsic allure of brands. This adjusted view radically transforms the leader board:

- Rolex, traditionally capturing a modest 1.73% of the search interest, skyrockets to a dominant 13.11%. Similarly, Cartier and Omega also leap forward. This shift illuminates the innate attractiveness of watch brands, especially when supply-adjusted, suggesting a latent, intense demand.

- Among the non-watch luxury mainstays, Chanel (4.14%) shines, surpassing Louis Vuitton (3.31%). Yet, it’s vital to emphasize that even when adjusted, Louis Vuitton‘s resilience is evident. It maintains a commendable position relative to its peers, emphasizing its entrenched appeal.

In summary, while raw search metrics depict a familiar luxury hierarchy, a supply-adjusted lens unveils hidden dimensions, spotlighting brands with intrinsic desirability and hinting at potential market trends in the horizon.

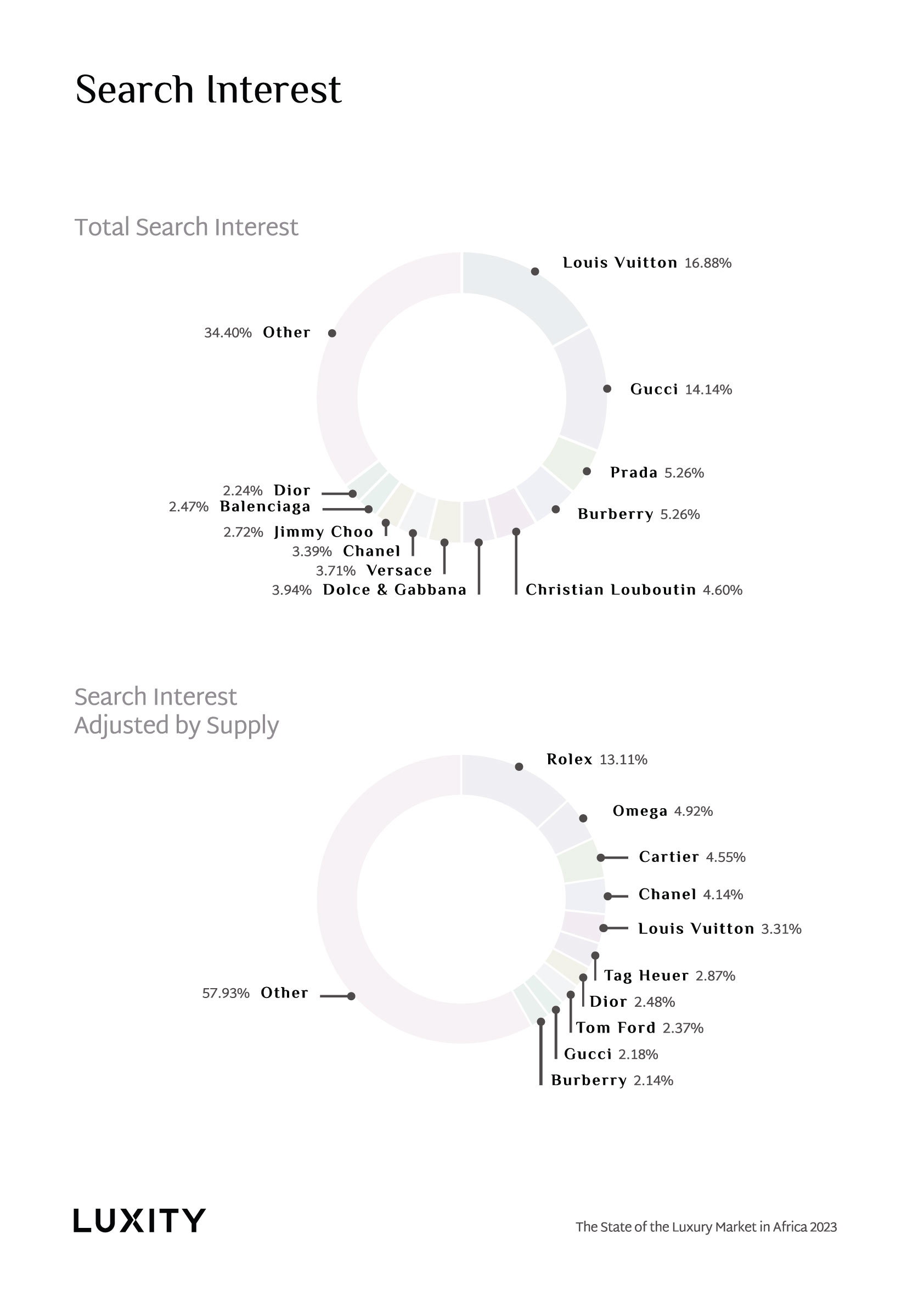

Search Interest by Category

While brand-wise search interest provides a glimpse into brand loyalties and shifting tides of preferences, examining search interest by category throws light on broader consumer behavioural trends.

For 2023, a few revelations stand out:

Shoes and Apparel, accounting for 24.86% and 14.73% of search interest respectively, have carved out a dominant space for themselves. To many observers, this might be counter-intuitive, given the reservations often associated with pre-owned items in these categories. The preconceived notion might lead one to expect a hesitancy towards previously-owned shoes and apparel. Yet, the data suggests otherwise. These categories either outpace or are on par with the traditionally ‘safe’ category of Handbags, which garners 18.03% of the search interest.

This trend underscores a possible evolution in consumer attitudes. The perceived barriers or taboos associated with pre-owned shoes and apparel might be eroding, making way for a more open, sustainable approach to luxury fashion.

- Delving into search interest by price range unveils a fairly predictable pattern, but with a twist. As anticipated, there’s a direct inverse relationship between price range and search volume: the higher the price, the lower the search interest. Yet, this narrative is disrupted when we reach the zenith of luxury price points. There’s a discernible uptick in searches within the most premium segment. This anomaly suggests a cohort of High Net Worth Individuals (HNWI) with distinctive tastes, actively scouting for the crème de la crème — the rarest, most exclusive pieces.

Such a trend sheds light on the unique dynamics of luxury consumption. While the majority might seek affordability within luxury, a niche segment is undeterred by price, driven solely by exclusivity and rarity.

Analysis of Return

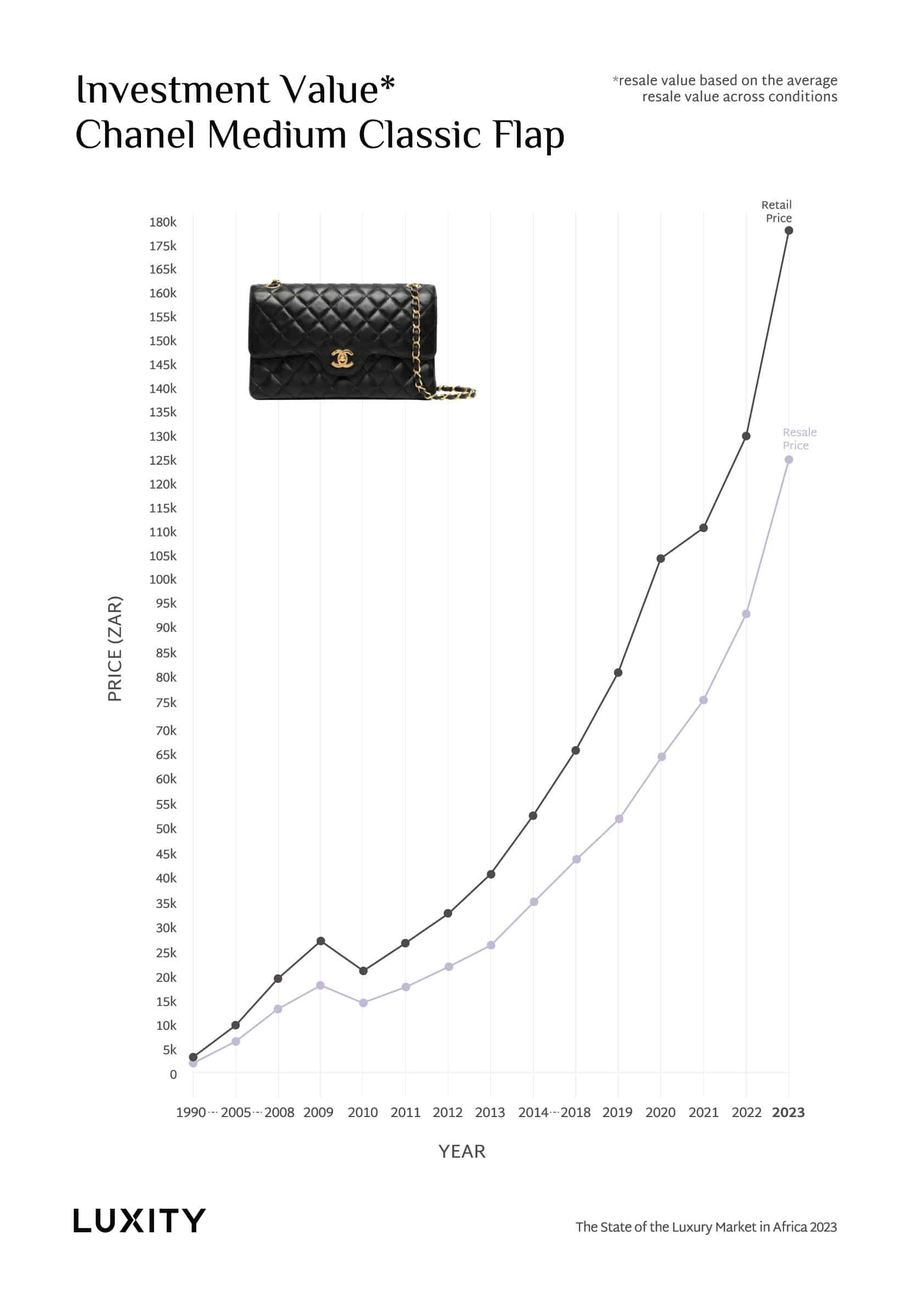

In the realm of luxury, there exists a unique intersection of utility, aesthetics, and investment. While luxury goods serve functional and symbolic purposes, certain items, over time, have also proven their mettle as formidable investment vehicles. To understand this dimension, let’s delve into the financial performance of one of the most iconic luxury items: the Chanel Medium Flap Bag.

For 2023, the financial trajectory of the Chanel Medium Flap Bag presents an intriguing tale:

- The retail price witnessed a steep ascent, surging from R135,000 to an impressive R170,000. Meanwhile, the resale value followed suit, propelling from R110,000 to R140,000. Two pivotal forces have fuelled this trajectory: Chanel’s strategic price increments and the depreciating dynamics of the Rand.

Such sharp escalations in both retail and resale prices underscore the inherent and rising value of this timeless piece, both as a fashion statement and an investment asset.

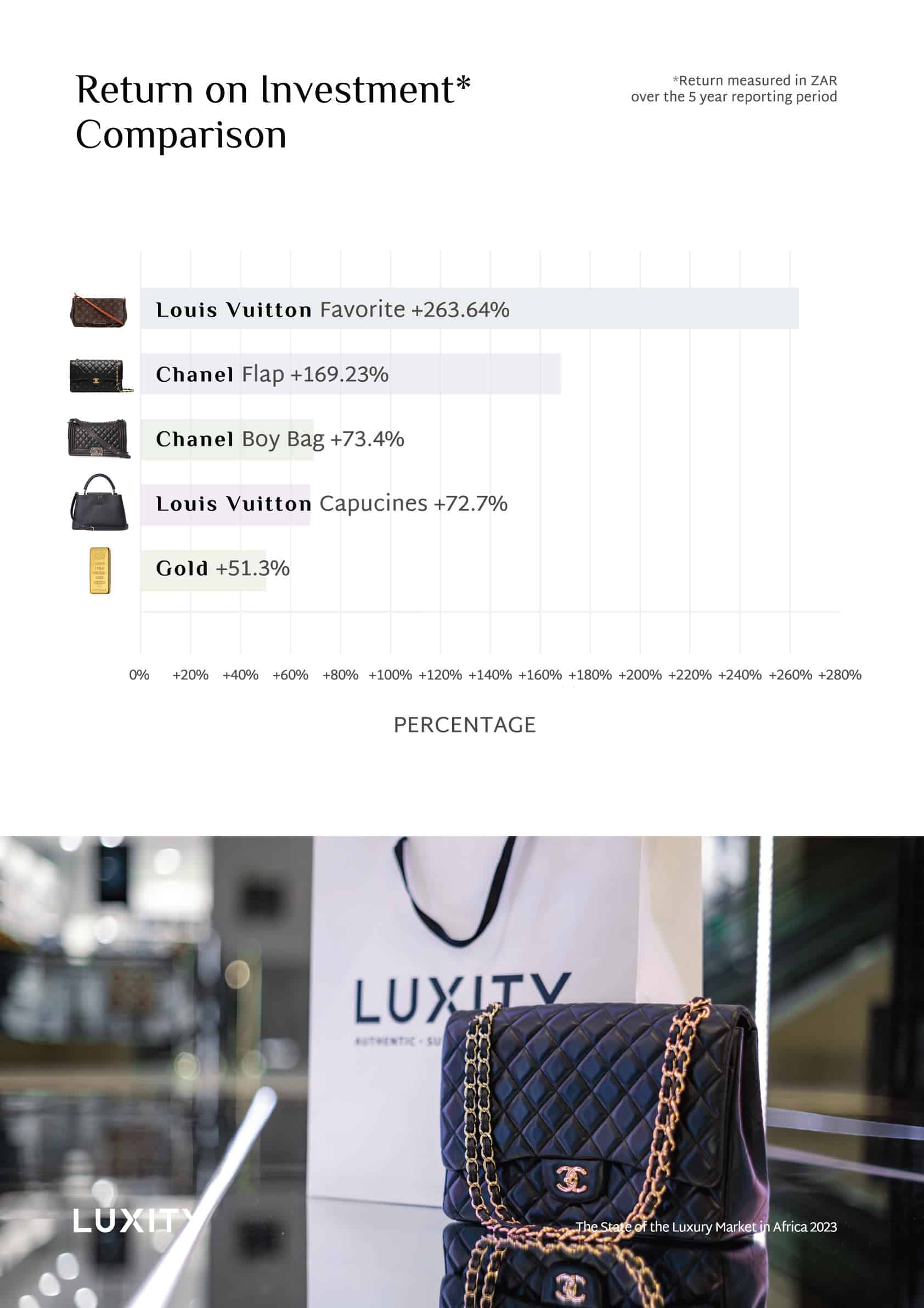

- In a broader context, when assessing the investment potential of luxury items, an enlightening comparison emerges. Several handbags, spanning top-tier brands and diverse price points, showcase remarkable appreciation over a 5-year horizon. So much so that they can outclass gold – traditionally viewed as the hallmark of stable investment – in terms of returns.

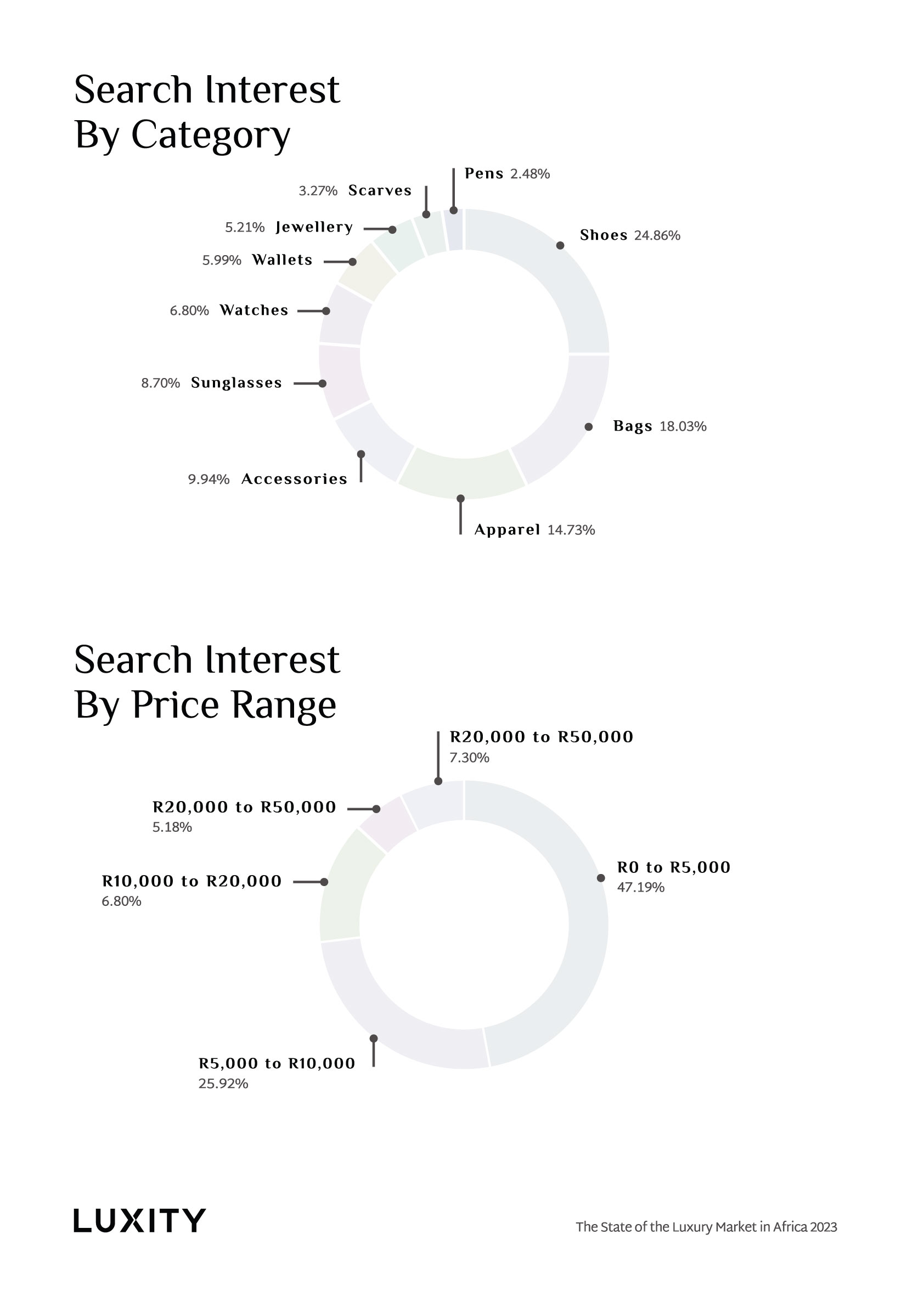

The Crown of Luxury Brands

As we culminate our annual dive into the intricacies of the luxury market in Africa, it’s imperative to spotlight the brands that have outshone their contemporaries and staked their claim at the pinnacle of the luxury hierarchy.

This year, the annals of our report see an unprecedented shake-up:

- Chanel: Making history, Chanel ascends to the coveted #1 spot, dethroning the long-standing leader, Louis Vuitton. What makes this feat even more remarkable is Chanel’s absence in the South African retail arena. Its dominance is purely on the strength of its offerings in the pre-owned market. This meteoric rise paints a vivid picture of unwavering brand loyalty and immense consumer demand, intensified by limited supply. It’s evident that High Net Worth (HNW) consumers, with their persistent affinity for the brand, have propelled Chanel to this zenith.

- Louis Vuitton: Although dethroned from the top spot, Louis Vuitton retains a formidable presence, emerging as the #2 brand. Despite being the leader in volume, the dynamic equilibrium between supply and demand seems to have shifted, suggesting that the brand’s offerings are reaching a saturation point for its core consumer base. Coupled with this is a possible waning resilience of the conventional luxury consumer, especially when juxtaposed against the ultra-wealthy segment.

- Rolex and Cartier: Both brands have etched an indelible mark this year, debuting at the 3rd and 4th positions respectively. Their ascent underscores the timeless allure of luxury watches and jewellery, with both brands resonating profoundly with aficionados and collectors.

- Gucci: Rounding off the top five, Gucci’s performance this year was a tad subdued. Yet, when we shift our gaze to volume metrics, Gucci asserts its dominance, comfortably securing the #2 spot. This dichotomy perhaps hints at evolving consumer preferences, even within established luxury clienteles.

In sum, 2023 has been a watershed year for luxury brands in Africa. The reshuffling at the top, the emergence of new favourites, and the nuanced dynamics between volume and value offer a rich tapestry of insights. It’s a testament to the ever-evolving, multifaceted nature of luxury consumption in the region. As brands jostle for prominence and consumers’ loyalties shift, one thing remains constant: the enduring allure of luxury.