State of the Luxury Market in Africa 2024

Welcome to the Seventh edition of The State of The Luxury Market Africa Report by Luxity, Africa’s premier pre-owned luxury reseller. This annual compendium reflects upon the dynamics, preferences, and trajectories within the luxury sector of the continent, with a pronounced emphasis on South Africa. Employing a robust combination of search metrics, traffic data, sales statistics, and additional external indicators, we strive to provide a comprehensive understanding of the luxury landscape in Africa.

Past Editions:

Luxity’s State of The Luxury Market Africa 2023

Luxity’s State of The Luxury Market Africa 2022

Luxity’s State of The Luxury Market Africa 2021

Luxity’s State of The Luxury Market Africa 2020

Luxity’s State of The Luxury Market Africa 2019

Luxity’s State of The Luxury Market Africa 2018

The Value of Luxury Brands 2024

The luxury market in Africa continues to evolve and grow, with 2024 marking a year of notable developments both globally and locally. Internationally, the luxury market is facing significant challenges, particularly in key regions like China. Despite notable growth in 2023, the Chinese luxury market is expected to slow to mid-single-digit growth in 2024. Factors such as weakened consumer spending, shifting buyer priorities toward bargains, and a slower-than-expected economic recovery have contributed to these struggles. Many luxury brands, including Gucci and Burberry, have experienced steep declines in sales and are resorting to unprecedented discounts to attract cautious consumers. Luxury e-commerce platforms like Farfetch and Yoox Net-a-Porter (YNAP) have also struggled, with YNAP pulling out of China and Farfetch narrowly avoiding bankruptcy through a deal with Coupang. These difficulties underscore the challenges Western luxury platforms face in competing with China’s advanced and competitive digital ecosystem.

Broader trends in the luxury industry indicate a slowdown, with personal luxury goods projected to grow by only 3-5% in 2024, compared to stronger growth in previous years. The current landscape is influenced by geopolitical tensions, inflation, and economic uncertainties that have impacted consumer confidence, especially in Europe and the U.S.

Locally, the Clur Shopping Index report highlights a robust 8% growth in luxury trading density in shopping centres over the past year, with an astounding 184% increase since 2019. Mid-range watches emerged as a standout sub-category, experiencing a significant 28% growth in the last year, reflecting an increasing interest in accessible luxury segments. This interest in accessible luxury is also translating well to the pre-owned industry, where consumers are seeking value-driven luxury options that offer prestige at a more attainable price point.

South Africa remains a leader in the African luxury market, boasting the highest number of luxury stores on the continent. Major malls, like the V&A Waterfront, are continually positioning themselves as luxury destinations, with the development of new luxury wings catering to this growing demand. With the largest population of high-net-worth individuals in Africa and a strengthening market sentiment, we anticipate the luxury market in South Africa to continue outperforming global growth. The pre-owned luxury segment has also maintained its growth trajectory, thriving both in-store and online. Despite challenges faced by some international online luxury platforms, local online demand has remained strong, even outpacing in-store growth. This trend underscores the growing appetite for luxury goods in Africa and the shifting dynamics towards digital luxury shopping experiences.

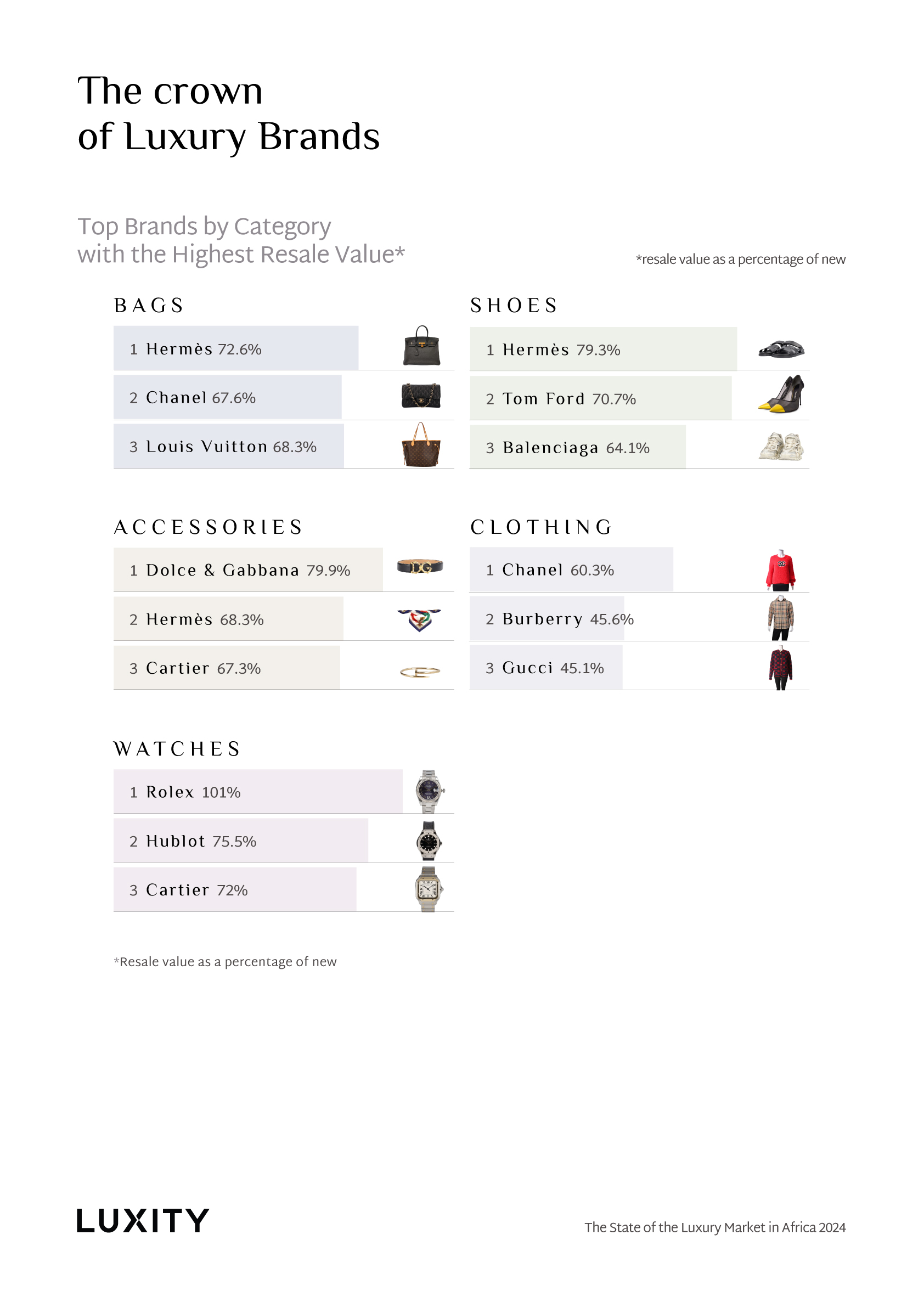

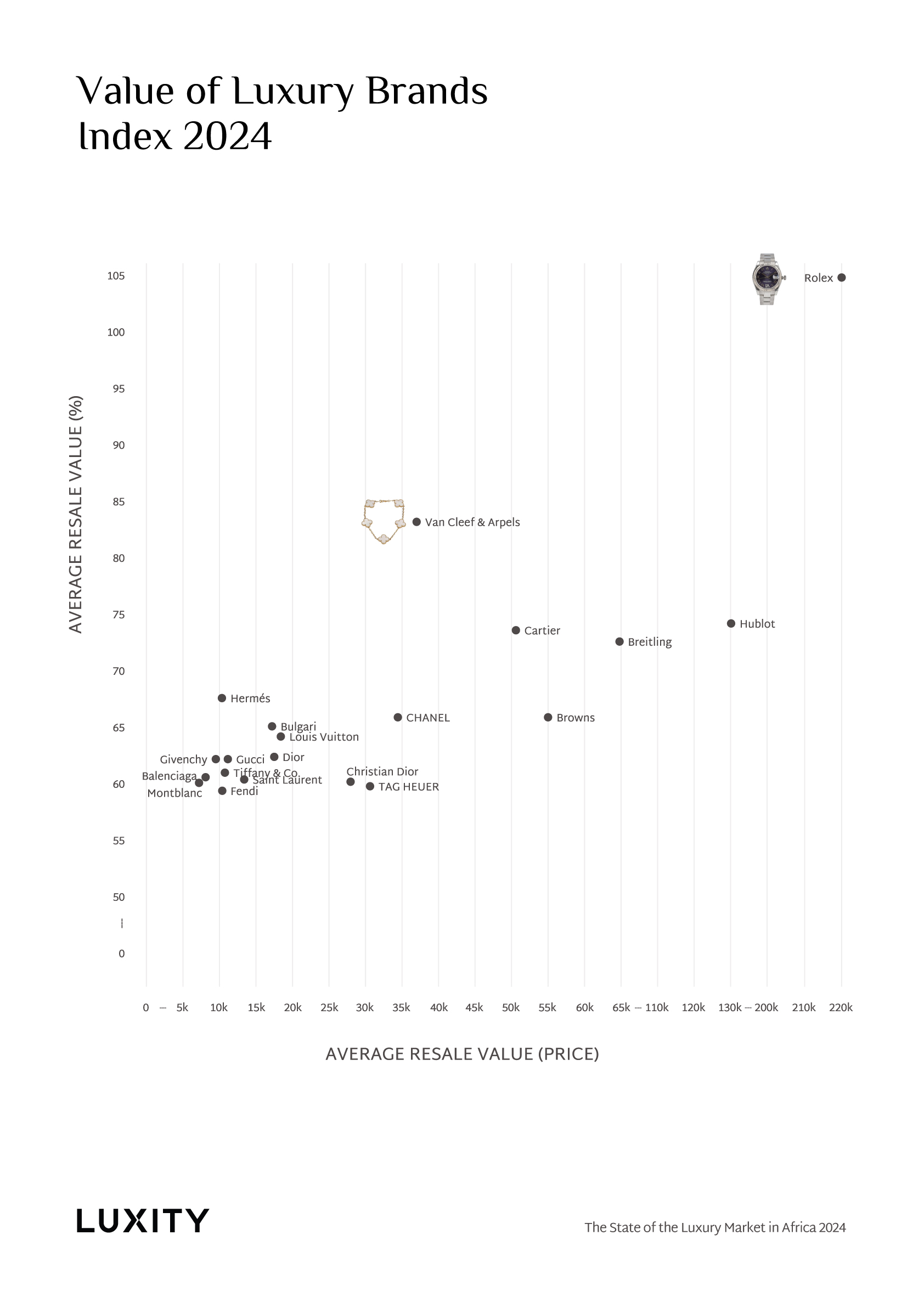

Resale Value

In analysing the resale values of luxury brands, a clear distinction emerges between fashion ateliers and watch/jewellery companies. Brands primarily associated with watches and jewellery, such as Rolex, Hublot, and Van Cleef & Arpels, significantly outperform fashion brands in terms of resale value retention, with Rolex standing out by reselling at 104.9% of its retail price. This demonstrates the exceptional investment potential of luxury watches and jewellery. On the other hand, fashion brands like Hermès, Chanel, and Louis Vuitton exhibit robust performance, maintaining resale values between 60% and 68%, outperforming many other fashion houses. Hermès, in particular, retains a value of 67.7%, indicating the enduring desirability of its iconic bags. A special mention goes to Browns, the only South African brand on the list. Despite being relatively smaller on the global luxury stage, Browns holds its own, boasting a resale value of 66% and an average resale price of R55,000, which is impressive when compared to well-established global luxury brands. This shows that Browns has managed to carve out a notable position within the competitive luxury market, standing shoulder to shoulder with international giants like Chanel and Louis Vuitton.

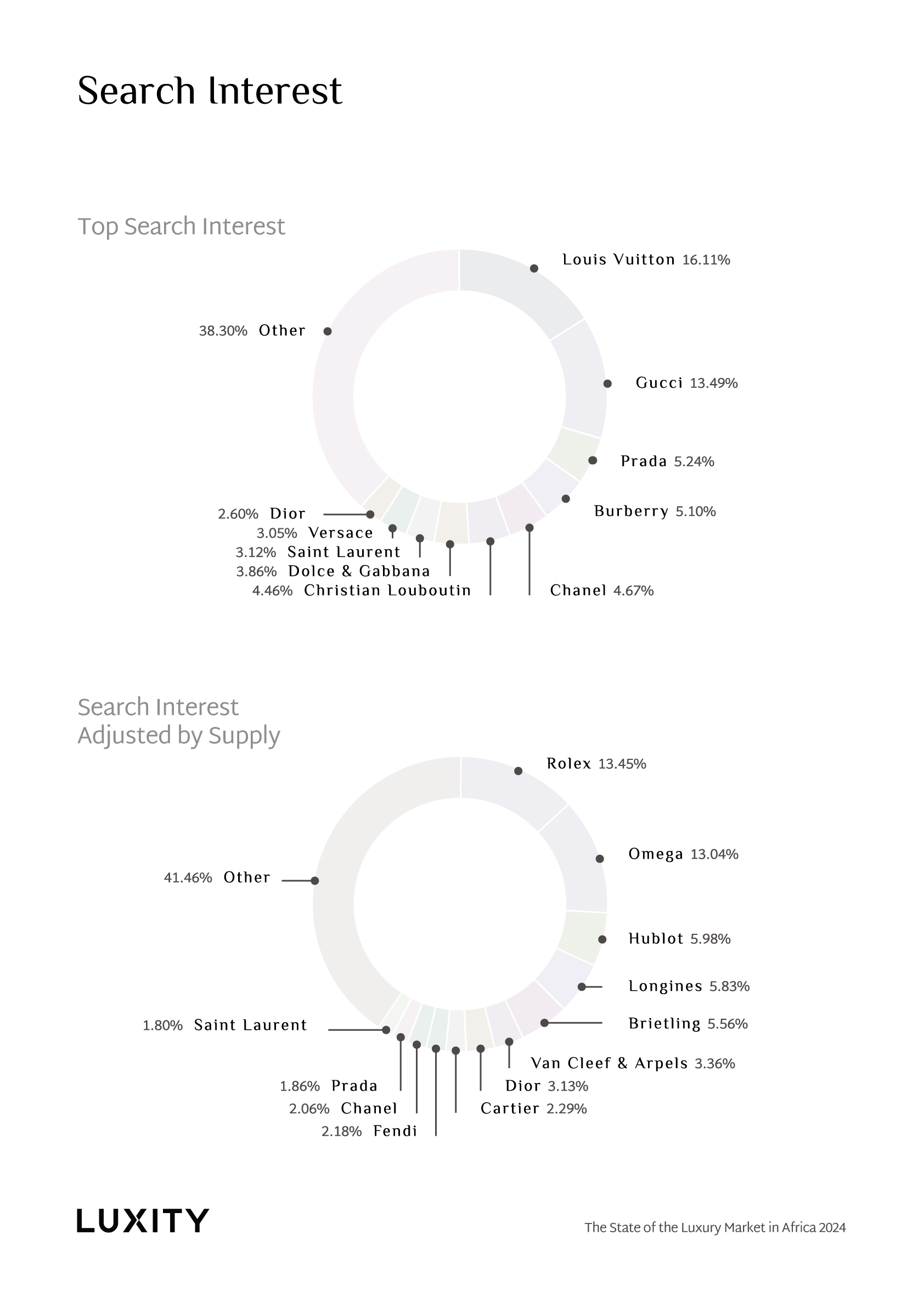

Search Interest

Search interest, a metric representing the number of searches within an online store, is a critical measure of brand awareness and desirability. This component, segmented by individual brands, gives us an insight into the pulse of consumer curiosity and potentially, intent.

Unbelievably, this year the top 5 brands remain completely unchanged and also hold relatively the same metrics. This speaks to the resilience of interest in individual brands and how generally popularity is unmoved by day-to-day trends.

Louis Vuitton and Gucci remain key standouts, attracting 3 out of 10 searches between the two of them. However, popularity doesn’t always translate into higher resale value. Both brands have seen a slight pullback in their resale value this year, despite maintaining strong consumer interest.

Adjusted Search Interest

For this metric, we adjust the search interest by the available supply. While Rolex remains the prime contender, we see a number of watch and jewellery brands taking over the top spots, pushing exclusive fashion brands further down the list.

If you are looking for an item that everyone wants but few people have, a Rolex watch or a Van Cleef & Arpels bracelet seems to be a sure bet.

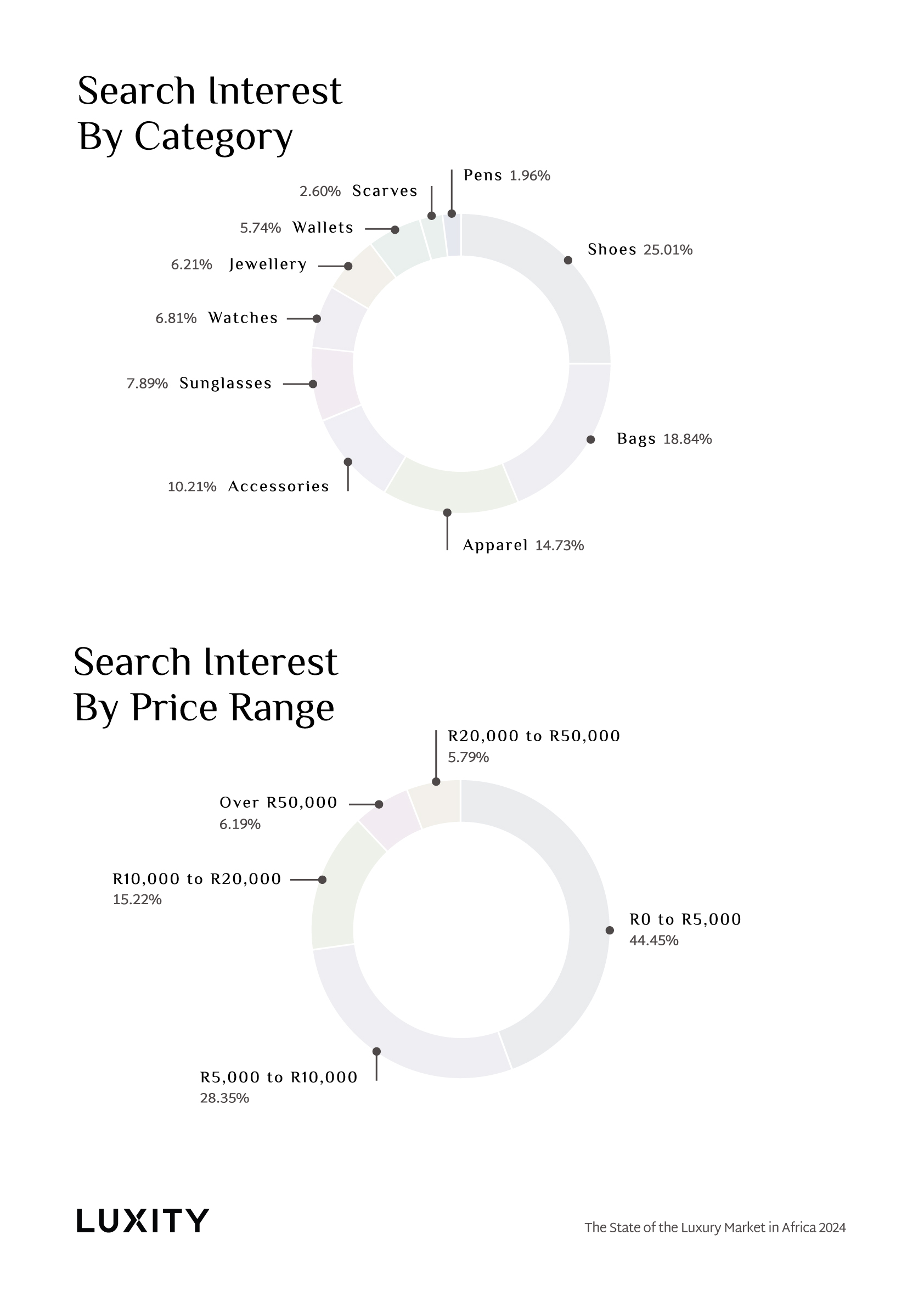

Search Interest by Category and Price

Search interest by both category and price has remained remarkably stable, showing no major movements in the market. There has been a small drop in search interest for the highest value of goods, R50,000 and above.

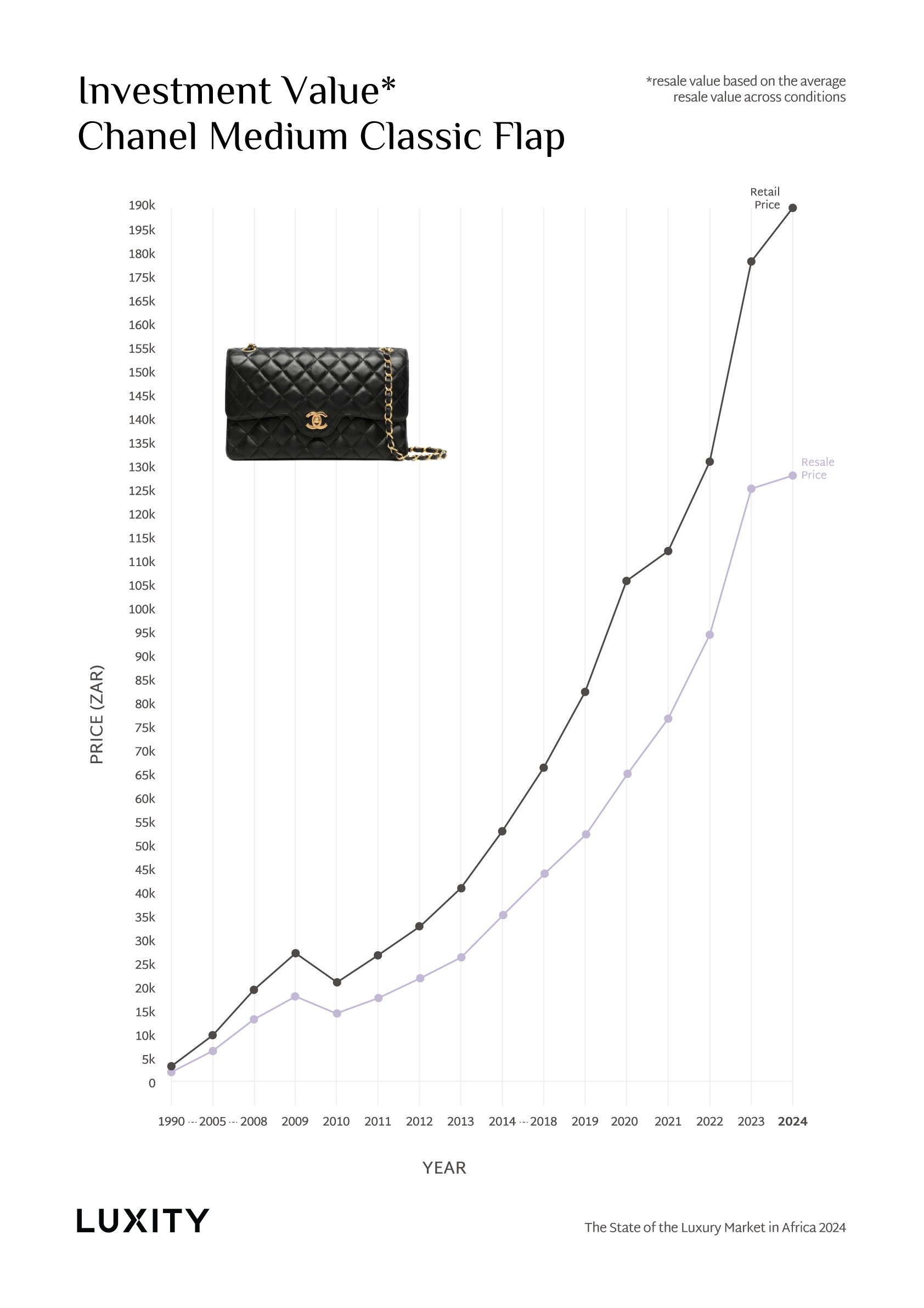

Return on Investment

We have been measuring the return on investment (ROI) of the Chanel Flap Bag for many years now. This year might mark the beginning of a flattening in the previously outsized returns, as many consumers are pushing back against Chanel’s twice-yearly price hikes. In 2024, the price of the Chanel Flap Bag increased by 5.9%, reaching R189,500. Meanwhile, a pre-owned Chanel Flap Bag is selling for R128,000, a 2.3% increase from last year’s R125,000. With the strengthening rand and a predicted slowdown in price increases, now might be the peak time to consider cashing in on this investment.

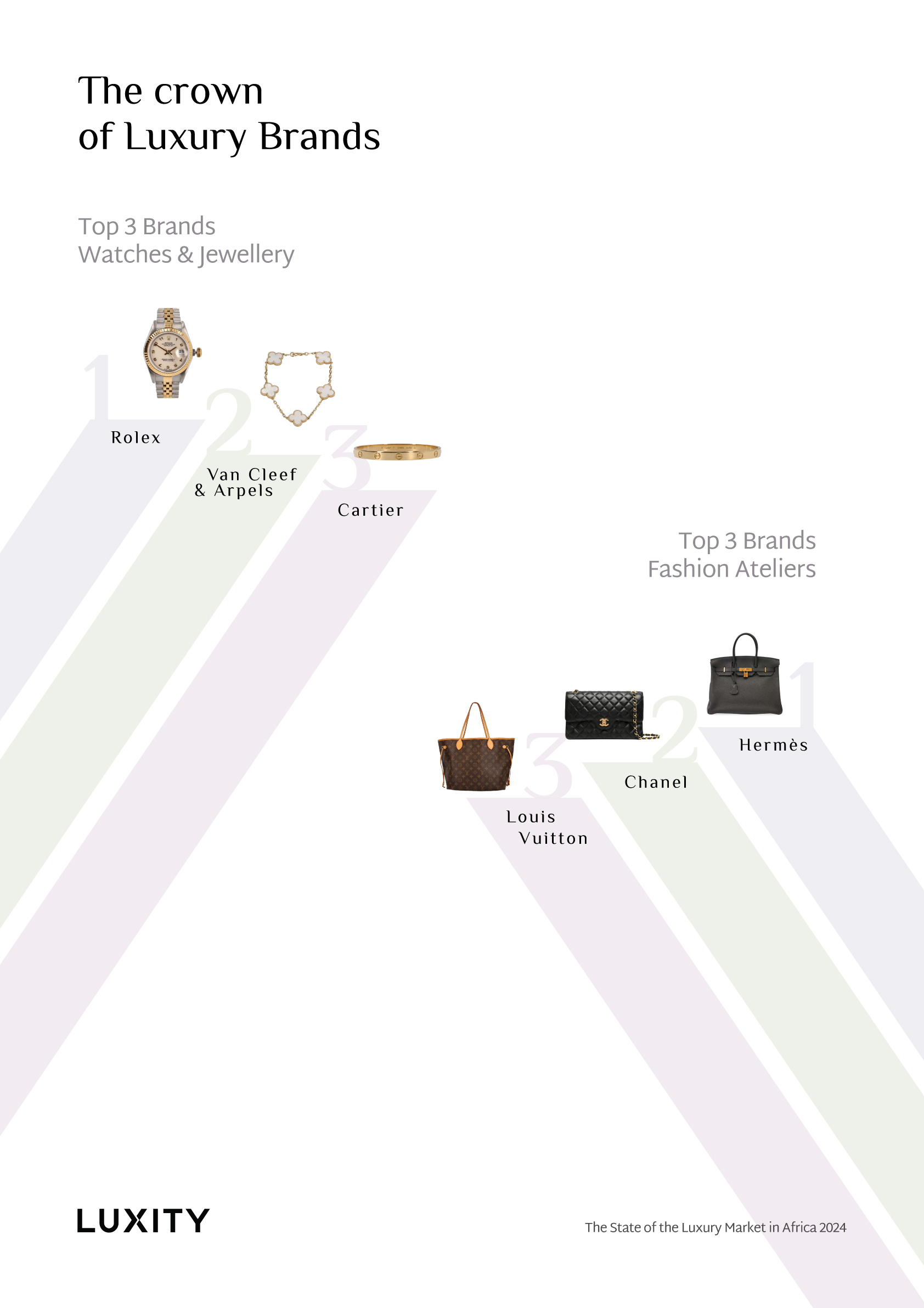

The Crown of Luxury Brands

This year, we have divided the contest into two key areas, driven by a clear market divide. The two categories are brands primarily focused on watches and jewellery, and those representing fashion ateliers.

The crown jewel truly belongs to the watches & jewellery sector, with Rolex leading the pack, followed by new entrant Van Cleef & Arpels, and Cartier rounding out the top three. These brands collectively resell for an average of 87.3% of current retail prices, with a combined average resale value of R92,000. If you are looking for a solid luxury investment, these brands remain unmatched in terms of value retention.

2024 has certainly been a year of shifts, as the post-pandemic luxury frenzy cools down. Exclusivity has become the new focus, and Hermès has emerged as the leader in this evolving landscape. Hermès now dominates the resale market in terms of returns, driven by exclusivity, with an overall return rate of 67% for ateliers. It ranks first in the Shoes & Bags category and second in accessories. Chanel, which previously held the top position, has fallen to second place, while Louis Vuitton has dropped to third, down from its previous second place.

It seems we are entering a new era, moving away from Louis Vuitton’s long-standing dominance. Exclusivity and quiet luxury are now in vogue, as Africa begins to closely mirror the trends seen in the Western luxury market.