Luxity’s State of the Luxury Market Africa 2020

The year 2020 is one full of challenges no matter the industry, country or region. Even setting the pandemic aside, in the 12 months since Luxity’s last report, a lot has happened. There has been increased web traffic for items in the second-hand luxury market, showing an uptick in public interest, and the prices of pre-owned items have recovered slightly.

ALSO SEE:

ALSO SEE:

Luxity’s State of The Luxury Market Africa 2023

Luxity’s State of The Luxury Market Africa 2022

Luxity’s State of The Luxury Market Africa 2021

Luxity’s State of The Luxury Market Africa 2019

Luxity’s State of The Luxury Market Africa 2018

Luxury Market in Africa – An Overview

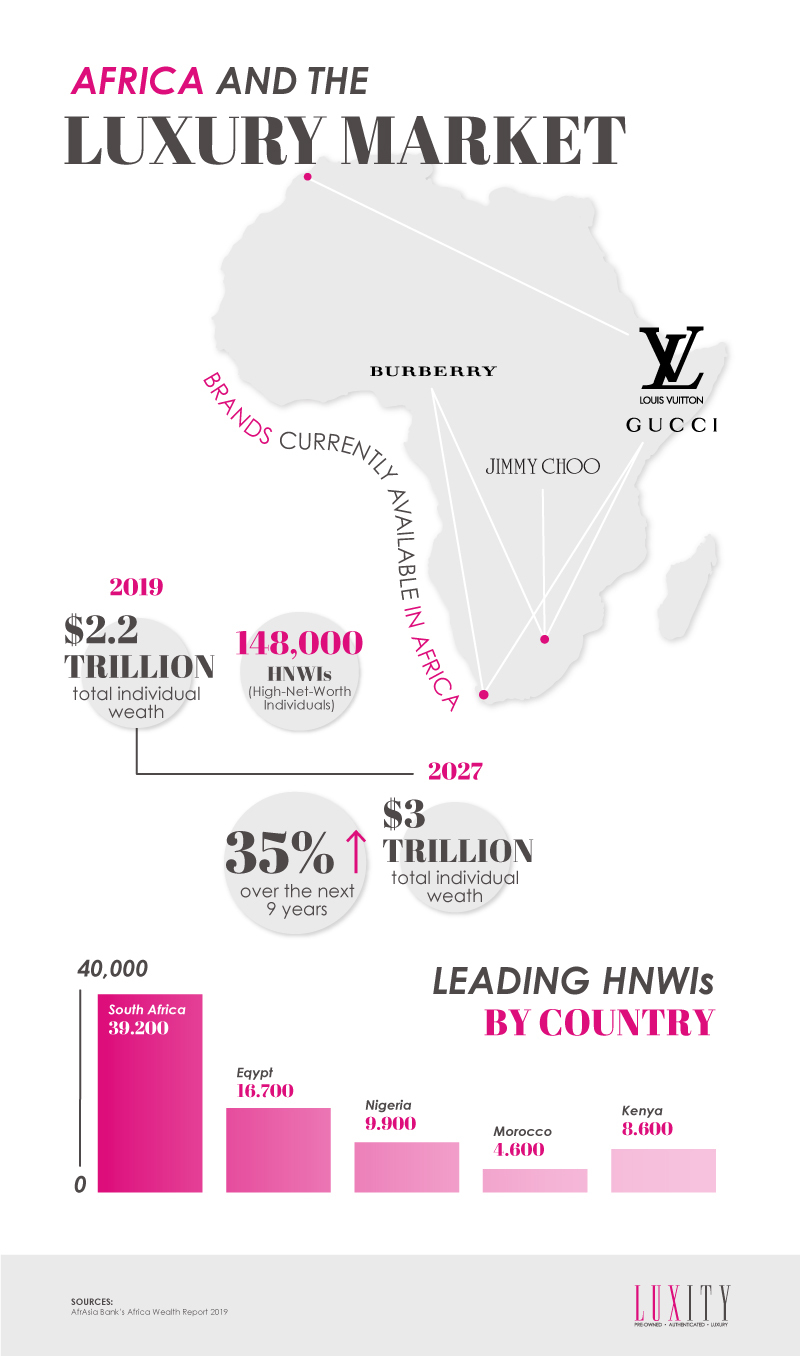

According to the Mauritius-based AfrAsia Bank’s Africa Wealth Report 2019, the total individual wealth held on the African continent amounts to $2.2 trillion, with around 148,000 HNWIs (High-Net-Worth Individuals). This wealth was expected to rise by 35% over the next nine years, reaching $3 trillion by the end of 2027. South Africa is leading the list with 39,200 HNWIs, followed by Egypt (16,700), Nigeria (9,900), Morocco (4,600) and Kenya (8,600).

A positive influence on the luxury market on the African continent is the mall culture that is present in most countries. This vibrant mall culture is particularly strong in Kenya, South Africa, Nigeria and Egypt, and presents ample opportunities for luxury brands to establish high-end retail outlets in desirable locations. In Cape Town, the V&A Waterfront is the centre for fashion brands Louis Vuitton, Gucci and Burberry, among others.

While luxury goods are beginning to be purchased through e-commerce platforms, where available, the physical market still held sway as a place to buy designer brand with customers prioritising in-store expertise and advice when parting with their money. This is another factor that might change in the post-Covid19 world where customers value social distancing overall and will opt to shop from the safety of their homes.

Luxury Goods in South Africa – an Overview

Already at the beginning of 2020, analysts were expecting a challenging year for luxury goods; and this was before the Covid19 pandemic and its effects were on anyone’s radar. The reason for this cautious preliminary outlook was the fact that South Africa’s real GDP growth in 2019 had slowed down quite drastically with consumer spending suffering as disposable income rose only minimally while credit restrictions tightened. Therefore, many luxury shoppers began looking at the pre-owned market more closely, which has become increasingly more attractive as it is less affected by trading conditions imported luxury goods are facing.

While the overall market for luxury goods in South Africa is still relatively small – especially compared to international ones like the UK and US, at Luxity, we are seeing a double-digit growth continue even through the Covid19 pandemic and resulting lockdown.

While South Africa’s overall economic outlook was forecast as modest but improving early in the year with the change in government and expected growth of both GDP and consumer confidence, the current pandemic’s effects are yet to be determined. Many cash strapped consumers are now selling their luxury goods, allowing, on the other hand, for once in a lifetime deals for the discerning buyer. This, coupled with a significant increase in price due to the drop in the South African Rand, is having consumers flock to the pre-owned luxury market for better value for money.

Luxury Market in South Africa

Essentially, the local consumer base for luxury goods consists of a small base of wealthy South Africans and foreign visitors to the country. Despite this, luxury brands are still (or increasingly) attracted to South Africa by an emerging and growing middle class. In fact, South Africa – with its already established luxury market, infrastructure and quality shopping centres – is becoming something of a shopping destination, since other countries on the African continent don’t have these offerings yet.

The competitive environment is highly fragmented with the most successful luxury brands in South Africa having their own stores through which they exclusively sell their products. The leading companies include Louis Vuitton, Prestige Cosmetics and Surtee Group (Versace, Armani, Burberry, Paul Smith, and others).

Resale Market

The global luxury resale market was set to top $41-billion by 2020, with an expected annual growth of 15% year-on-year from 2017. At Luxity, the largest source of pre-owned, authenticated luxury in Africa, we dug through our database to provide once again our annual state of the luxury market report for 2020.

Overall, the top five performing bands in South Africa, based on a combination of factors were, Louis Vuitton, Christian Louboutin, Gucci, Chanel, and Hermès.

“We’ve had an amazing year, and we’ve been able to record interesting data from our buyers and sellers,” says Michael Zahariev, Co-Founder of Luxity. “The increase in sellers and the increase in retail prices, due to the foreign exchange rate of the Rand, has led to a slight decrease in sales prices in relation to retail prices. This, however, doesn’t mean that purchasing a pre-owned luxury bag is a bad investment. In fact, the contrary is happening with the growth of prices still outpacing inflation and luxury items acting as an exchange hedge.”

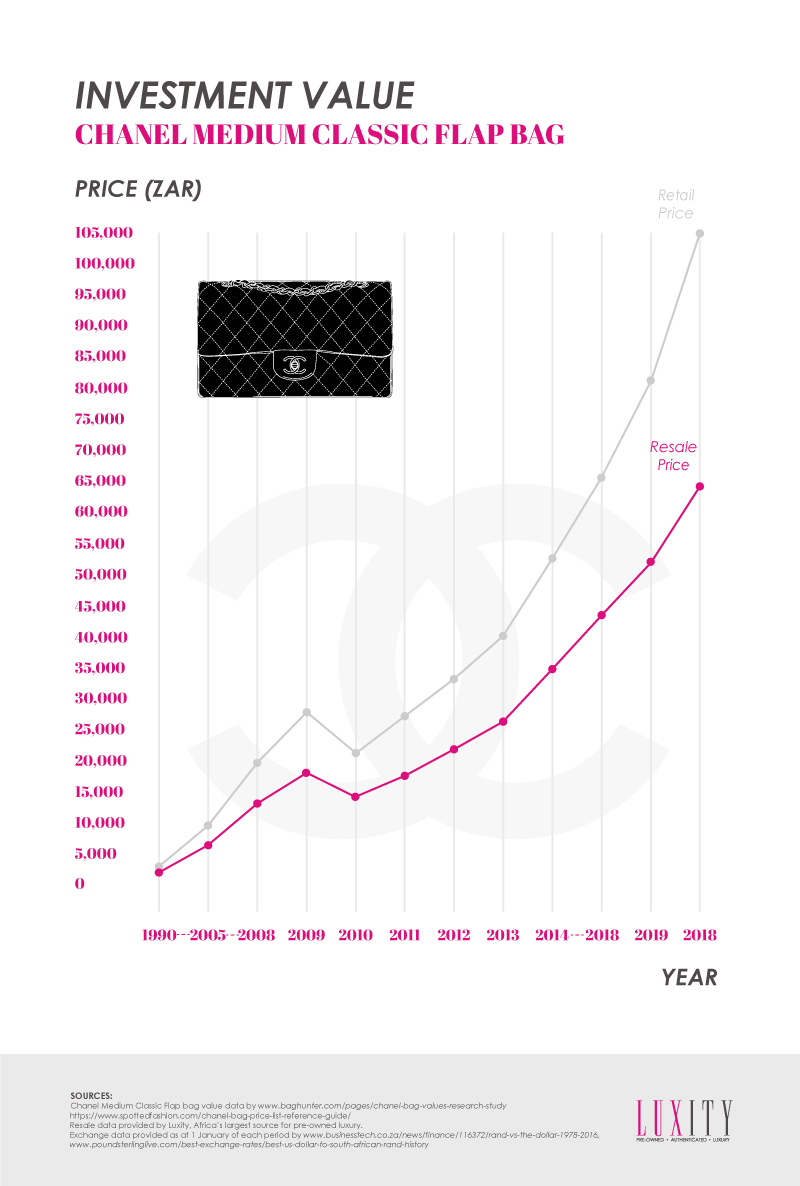

Arguably, still one of the best investment luxury bags is the Chanel Medium Classic Flap. It’s the gold standard.

Chanel’s retail asking price grew way above inflation when considered in the local currency, seeing a 21.2% increase year-on-year (YOY). The pre-owned resale price bumped up slightly softer by 17.7% YOY.

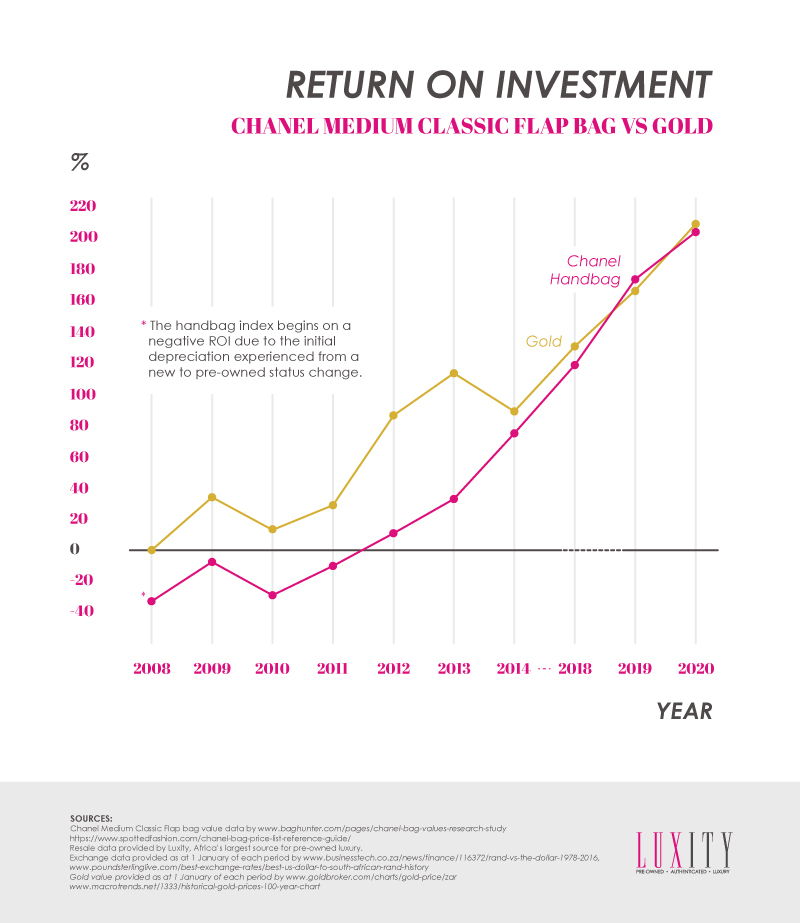

While there has been renewed hype around the growth of gold in markets, Chanel’s iconic handbag remains almost as good an investment as gold, reinforcing it as the gold standard of handbags.

This is just further evidence to support the notion that investing in a luxury handbag is not only a good fashion decision.

As for the return on resale value, the contenders in the handbag sector changed slightly in the last twelve months, with Louis Vuitton taking back the throne, Christian Louboutin making its first appearance in the top three and Chanel dropping to third place.

The shoe segment, as well, saw a drastic shake-up: Hermès took this year’s top spot, due to its general unavailability in the domestic market. Furthermore, Tom Ford placed as the second-best resale shoe and knocked Christian Louboutin down to third place.

With accessories, Christian Louboutin claimed first place with an average 68% resale value, toppling Hermès off the throne. Overall, you are still winning if you own an Hermès scarf, despite another slight decrease in the resale value of 1%.

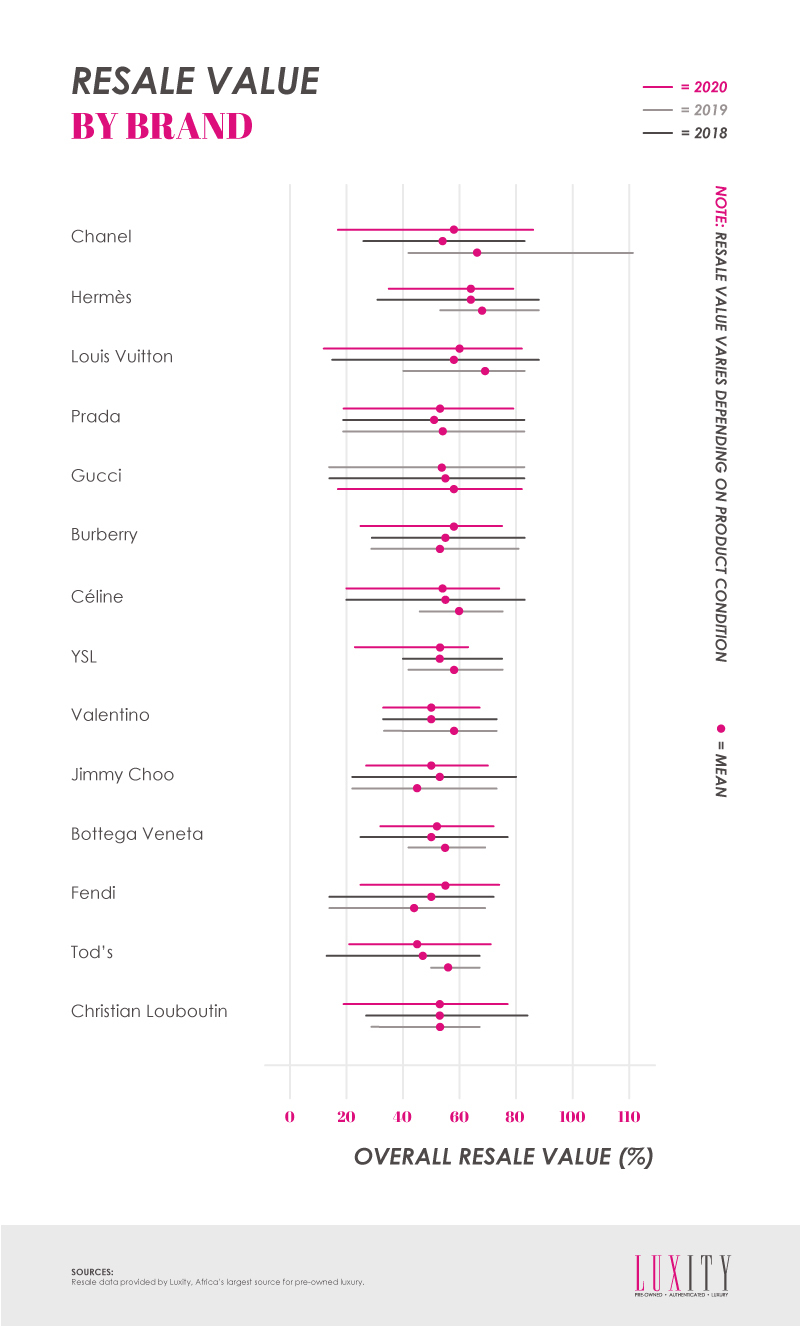

With the increased supply of stock across all the brands, we have seen marked variations between the minimum and maximum resale values. These differences are due to a number of reasons but usually related to the condition of the item.

After a drop in the mean resale value of most brands from 2018 to 2019, many are up again in 2020, such as Chanel, Hermès, Louis Vuitton and Bottega Veneta.

While Christian Louboutin’s resale value has been very consistent over the last three years, both Fendi and Burberry are the only brands where the resale value has increased every year.

Burberry is one of the brands that attracted the millennial market, which is eager to get into the luxury market. This is in line with the younger brand repositioning of Burberry driving renewed interest in the brand. Luxity was also able to gauge the uptick in Fendi’s prices, also in line with international trends, with a particularly large demand being driven by buyers in the Mother City.

The general trends we noticed over the previous years have proven consistent. One such trend is that Generation X buyers were predominantly still gravitating towards popular brands such as Louis Vuitton, Chanel, Gucci, and Hermès. With Louis Vuitton remaining the favourite in Johannesburg, while Chanel leads the way in Cape Town.

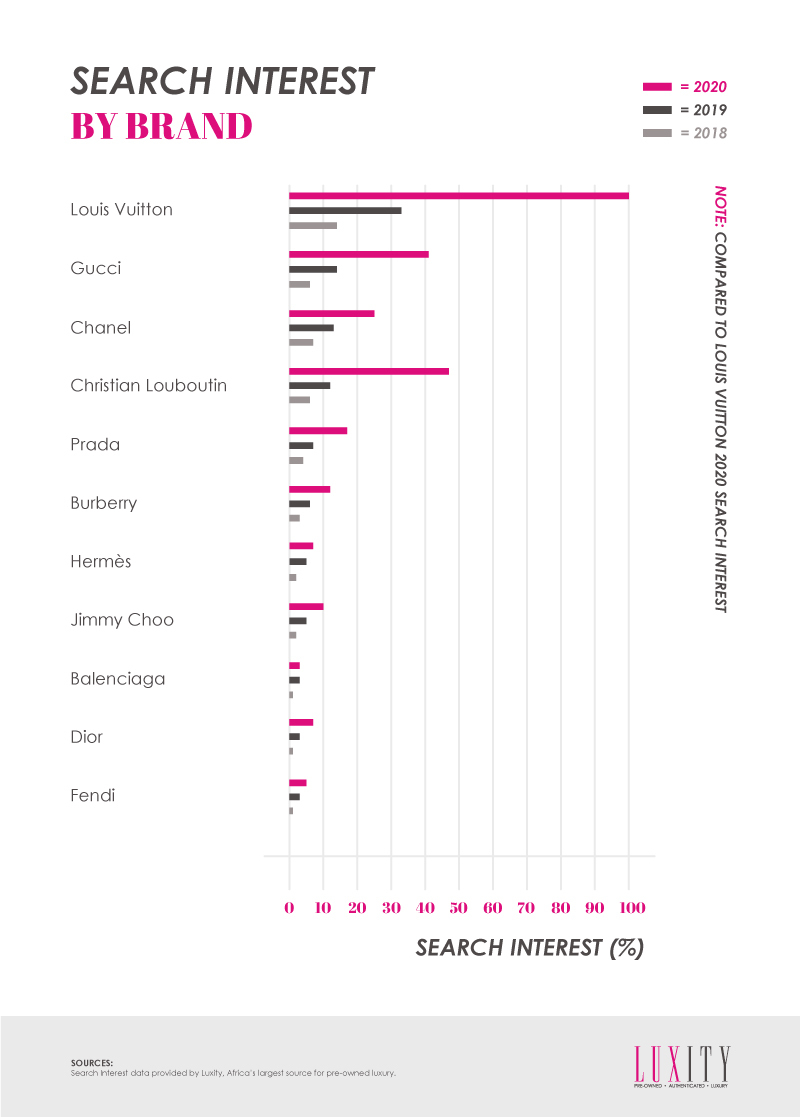

In regards to what brands interested our potential shoppers, we tracked searches on our website and compiled a YOY comparison.

Louis Vuitton took the most-searched-for top spot by a large margin for the third year running, tracking over 100% more interest than the runner-up brand, Gucci.

The top four brands were vastly more popular in terms of searches than the remaining six. This being said, there was still a significant increase in interest across all brands monitored, affirming the growth of the pre-owned industry.

These findings are all in line with current international trends. “It’s always interesting digging into our sales and search results to compile data,” says Zahariev, “This data paints an amazing picture: If you’re a Cape Town millennial, you’re bound to be interested in Fendi, while your parents will most likely be searching our website for that Louis Vuitton bag to take on their next trip,” concludes Zahariev.

[products category=”handbags” cat_operator=”AND” columns= “3” Limit=”6″ order=”Desc” orderby=”date”]