State Of The Luxury Market In Africa Report 2021

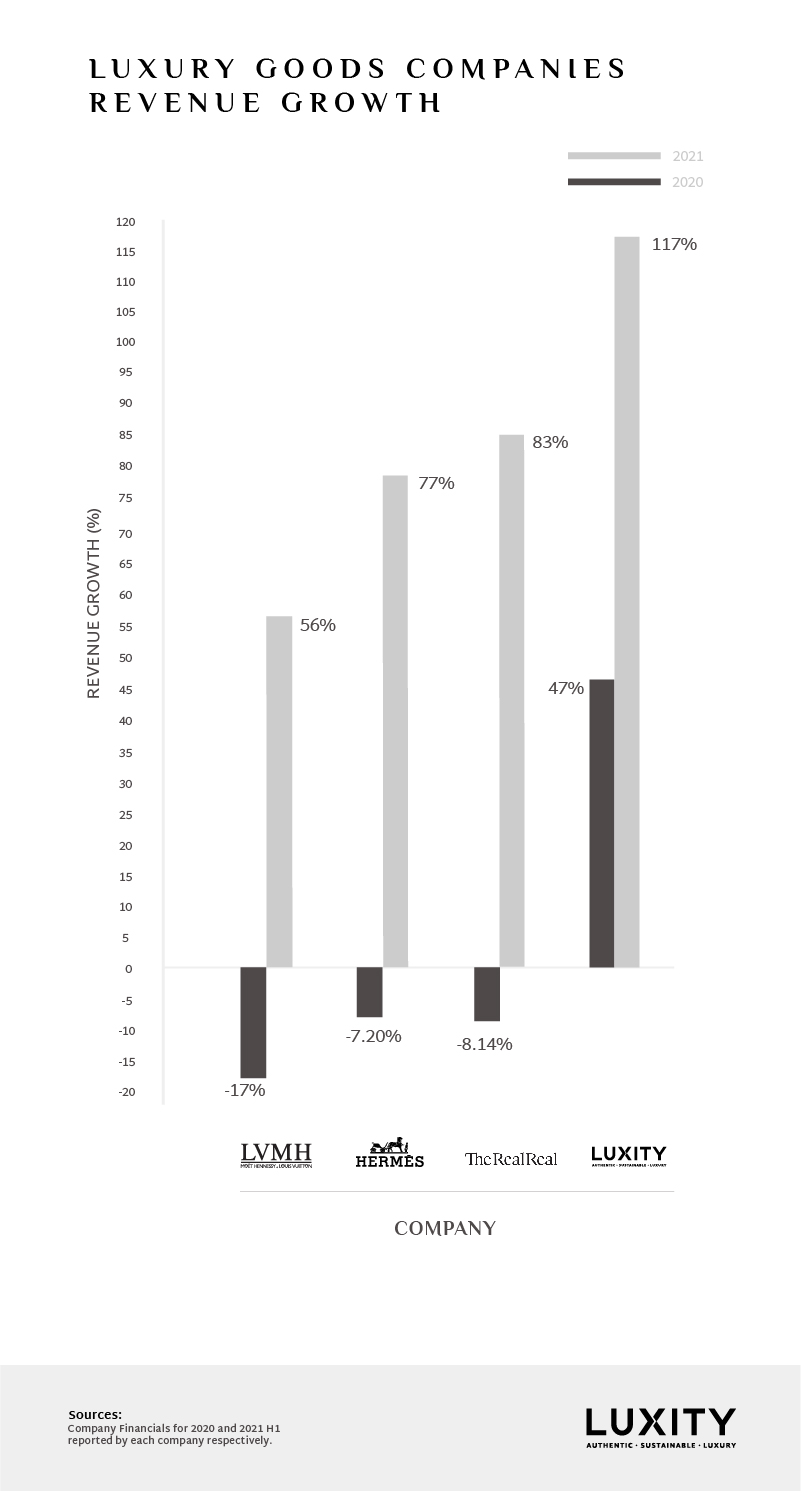

In what has been a challenging period for many industries, 2021 has seen the resilience of the luxury goods market globally. Powerhouse French players such as LVMH and Hermès did incredibly well, reporting 56% and 77% growth compared to the 2020 year respectively.

ALSO SEE:

Luxity’s State of The Luxury Market Africa 2023

Luxity’s State of The Luxury Market Africa 2022

Luxity’s State of The Luxury Market Africa 2020

Luxity’s State of The Luxury Market Africa 2019

Luxity’s State of The Luxury Market Africa 2018

Similar growth is being seen in the second hands luxury goods market internationally with the American TheRealReal preowned luxury report indicating 27% and 91% growth in the first and second quarters of 2021 respectively.

The prosperity of the luxury industry has catapulted Bernard Arnault, executive chairman of LVMH (holding company for Louis Vuitton, Christian Dior, Givenchy, Marc Jacobs, Kenzo and others) to a net worth of up to US $ 190 billion. He now holds the position as one of the world’s richest men.

While some attribute the growth in spending on luxury to the fact that the wealthy were not able to travel during this time, the question is whether this growth can continue as the western world heads towards Covid-19 heard immunity, with lockdowns being lifted and international travel set to resume.

1. https://jingdaily.com/lvmh-first-half-2021-earnings-louis-vuitton/

3. https://investor.therealreal.com/

LUXURY GOODS IN SOUTH AFRICA

Although South Africa is a relatively small market in the context of the global industry, and the country was one of the hardest hit by the Covid-19 pandemic driven lockdowns, the luxury goods industry has shown that it is equally resilient. In fact, the sector did remarkably well.

The trend of double-digit growth has certainly been seen in South Africa with frequent queues being reported in Sandton City’s Diamond Walk, the area of the prestigious centre housing Louis Vuitton, Gucci, Dolce & Gabbana and other luxury boutiques.

With few countries allowing South Africans and Africans abroad, high net worth individuals across the continent have flocked to South Africa as a premium shopping destination. Sandton City, for instance, has remained resilient through this period partly due to this reason.

PRE-OWNED LUXURY IN SOUTH AFRICA

In a similar fashion to what is happening internationally, the pre-owned luxury market in South Africa has seen exceptional success. Whereas the culture of buying pre-owned luxury is well established overseas, this sector has only taken root locally in the past five years and is being welcomed with open arms by consumers. This approach is opening the world of luxury to new generations of aspiring trendsetters, adoring fashionistas and discerning collectors who have adopted the pre-owned route for reasons such as increased brand popularity, easier access to goods, flexible payment terms and the ability to procure rare items that are not available new in the country.

South Africa’s biggest pre-owned luxury reseller, Luxity opened two new stores (Nelson Mandela Square and Menlyn Maine) and in doing so, increased their retail floorspace by five-fold in the height of the pandemic. Their customers have shown great appreciation for the convenience and efficiency that the company’s omni-channel approach provides them. While most purchases are still made online, these shoppers still enjoy the experience of collecting their purchases in the luxurious store environment.

This trend is translating into record growth with Luxity reporting the astounding results of 47% growth in the year ending 2020 and 117% for the first half of 2021.

TOP CATEGORIES FOR RESALE

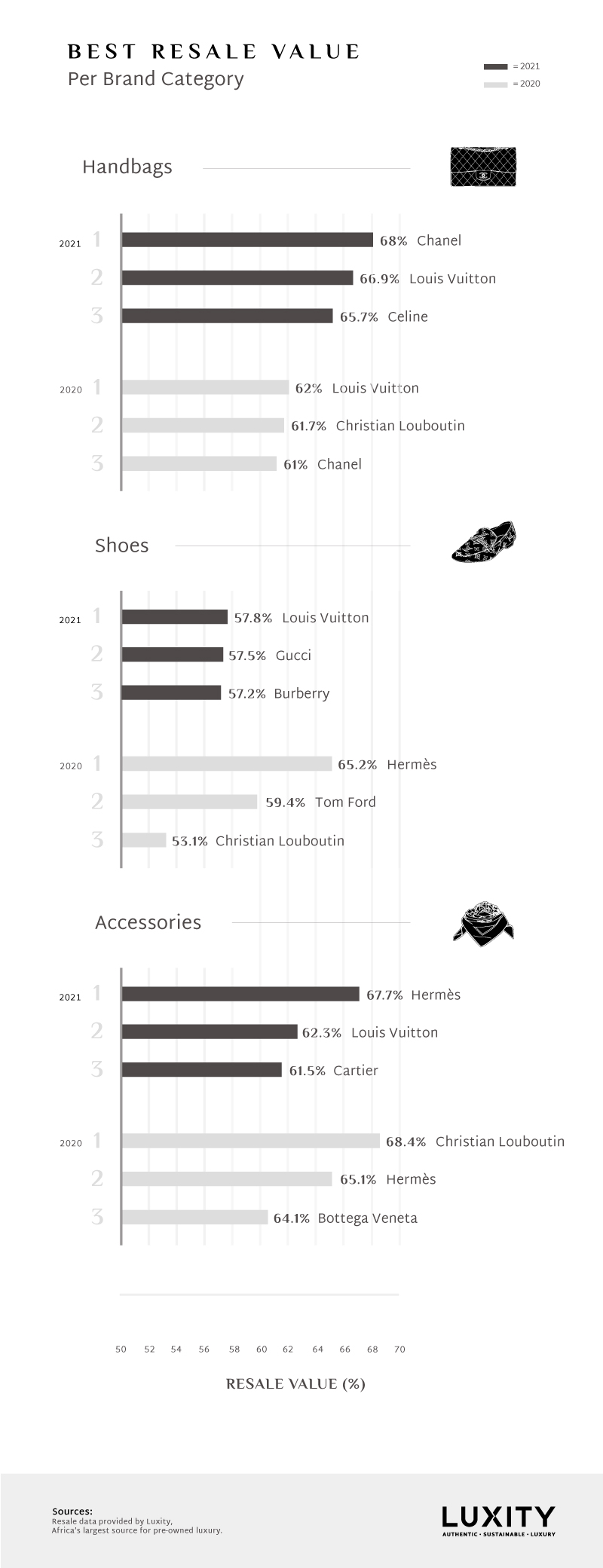

These results refer to the resale of various luxury goods, and how well these brands performed in terms of resale value vs retail price in the pre-owned luxury retail context.

There has been an increase in sales across all the categories as the culture of buying pre-owned luxury is being embraced in South Africa.

In the handbag category, Chanel rocketed to the first position, now holding the spot as the highest investment return luxury bag to buy pre-owned in South Africa, outperforming Louis Vuitton which now sits in a close second position, followed by Celine. This was influenced by a strong demand for the timeless brand as well as the fact that the company does not have a store in the country. Therefore, with travel restricted, Chanel accessories could not be bought in any other way.

Overall, there was strong growth across the category with the top three brands all returning more than their predecessors the previous year which signals a growing appetite for pre-owned.

The shoe category saw a drop in the average growth since last year. This is attributed to the fact that the volume of supply was higher than the demand for the category.

Activity regarding the sales of pre-owned accessories remained stable, and Hermès returned to its number one spot. This was influenced by the popularity of their coveted scarves remaining high and a low supply of these in the country.

Royal favourite Cartier made its first appearance in the accessories top 3 list. Its high return is attributed to the demand for its sought-after jewellery, again, with little supply in the country. Further growth is anticipated for this brand which indicates a positive growth curve due to high celebrity presence overseas and timeless signature designs.

Luxity started selling pre-owned watches half-way through the reporting period, with consumers being quick to catch on to the possibilities being offered by this approach. Despite the short trading time, this category did exceptionally well as watches are viewed more as an investment than the items in any other category.

The highest return for a watch brand was Rolex, returning 87,5% on average when comparing resale price to retail. It is expected that this standing will remain unrivalled for years to come.

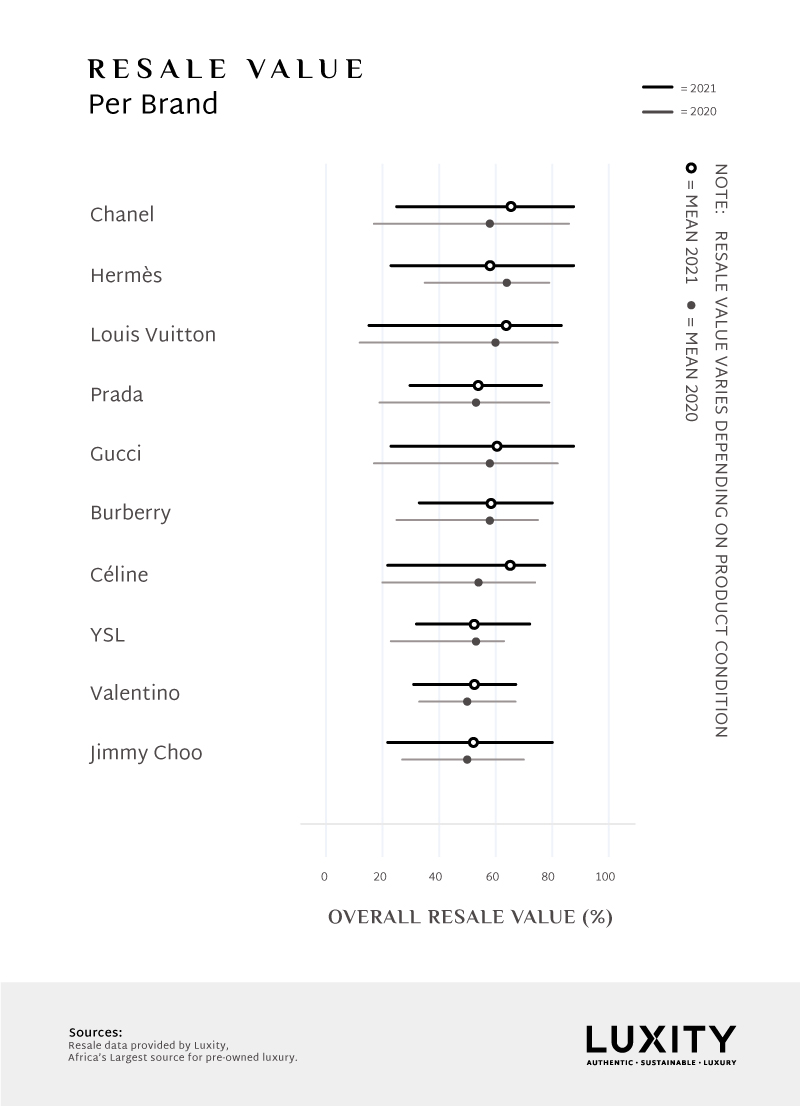

The growing adoption of preowned luxury is made even more evident when one considers not only the averages which grew in 8/10 of the top brands, but also the ranges.

More importantly, the upper range resale vs retail also saw growth in 9/10 of the top brands. 60% of the top brands delivered over 80% of current retail for select items.

Considering the average retail price increases at 15% per annum on luxury items, this is a clear indication that with the correct selection, certain pre-owned items, even across brands, can serve as excellent investment pieces.

Additionally, the wider min/max price ranges across the majority of the brands is further indication of a growing acceptance of the market as it indicates consumers are willing to by items across a larger variety.

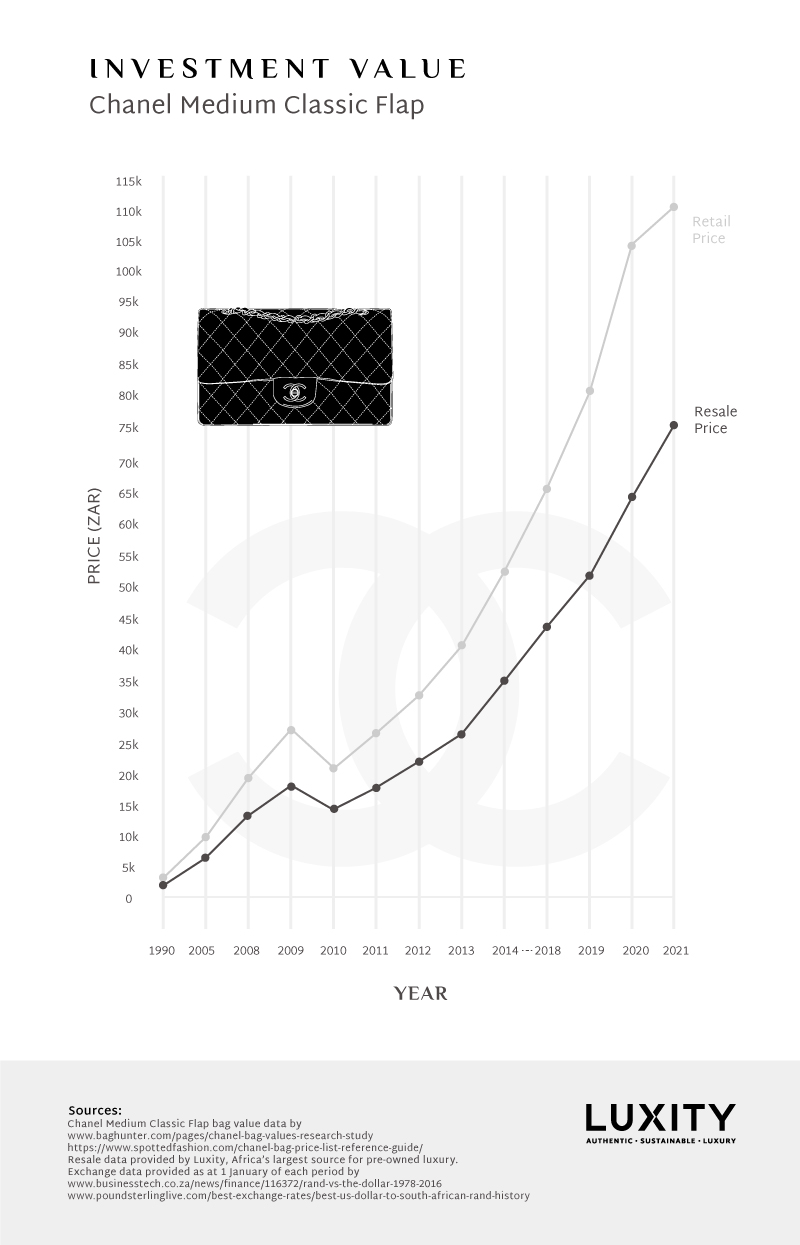

As expected, the price and relative resale value of the beloved Chanel Classic Flap bag continued to increase.

Despite the retail price only increasing slightly (5,21% in rand value, mostly due to the strengthening of the rand compared to the same period last year), the resale value of the Chanel Medium Classic Flap bag grew by 17,25% in the same period. This was driven by the enduring, classic nature of the brand as well as the increased resale/retail price of Chanel, due to lockdown-driven supply restrictions.

This further supports the notion that the Chanel medium Classic Flap bag is not only a great investment but can also function as a currency hedge.

Interestingly, this resulted in Chanel once again taking the top spot of investment return when compared to gold over the tracking period starting in 2008.

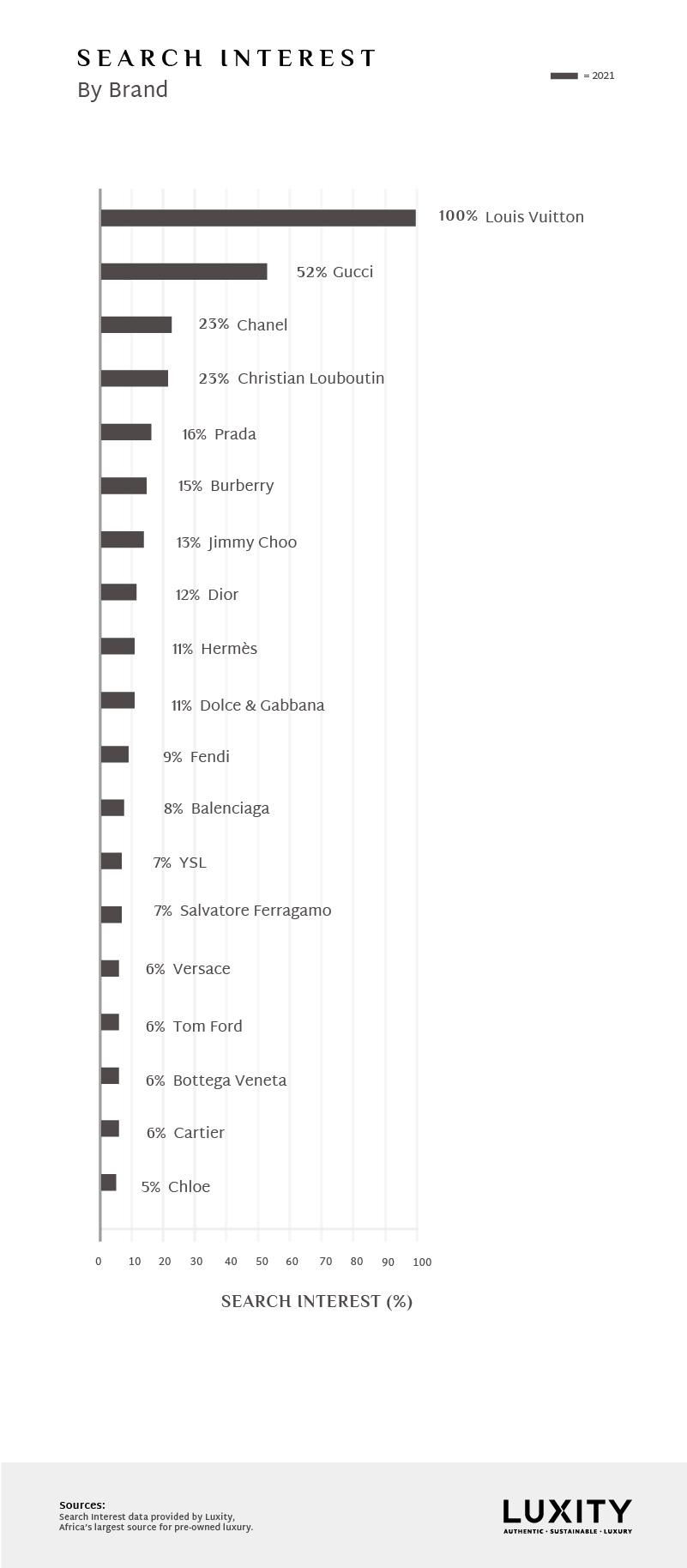

Based on user search interests, it is clear that despite not being the highest growth-wise, Louis Vuitton is by far the most sought-after luxury brand in South Africa.

In fact, only Gucci at roughly 50% of the interest comes close to challenging Louis Vuitton in this category with all other brands being at least four times less popular than Louis Vuitton.

An interesting case to consider is Chanel, which comes in third with a quarter of the interest of Louis Vuitton, and has no physical presence in South Africa. This can be seen to be one of the major contributors to the strong resale value growth in South Africa.

Hermès is the only other case whereby the brand is not available new in South Africa and features 9th on the list with roughly 1/10th the interest in Louis Vuitton and less than half that of Chanel.

The top overall brand for 2021 remains Louis Vuitton which shows tremendous longevity across all categories in terms of sales as well as interest. Based on strong overall performance and the highest interest, Louis Vuitton was able to maintain its position as the most popular luxury brand in South Africa in the pre-owned market.

With its incredible results fueled by the growth of luxury and market conditions, Chanel was able to take second place. One can only wonder what is preventing the prestigious brand from making its first leap into Africa. Perhaps this is not a data-driven discussion?

A new entrant in the top 5 for this first time is Burberry. The iconic British luxury brand came in 5th position, showing admirable performance in the shoe category and coming in 5th in terms of interest as well as showing strong growth in the upper range of return. This may also be fueled by the international growth in desirability of Burberry due to their increasingly modern appeal.