Luxity’s Study of the Luxury Market in Africa 2018

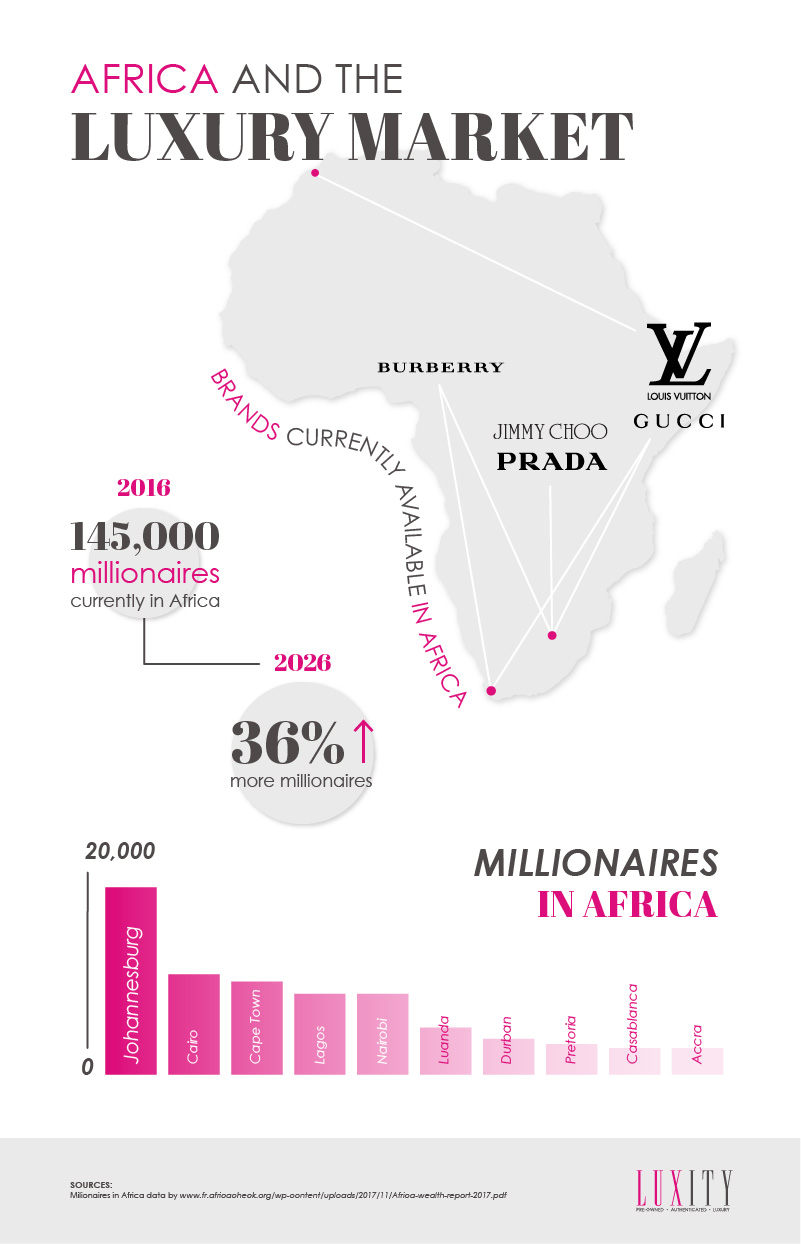

Surprisingly, the world’s fastest-growing economies are in Africa, and with that comes a growing demand for designer brands. According to New World Wealth, the current number of millionaires in Africa is 145,000 – this number is set to grow by 36% by 2026.

Furthermore, the growing middle class on the continent has displayed the desire to spend on designer brands that are not readily available in their countries. An excellent example of this is Nigeria, where the population is not only enjoying a high economic growth rate but a keen growing interest in designer brands as well.

SEE ALSO:

Luxity’s State of The Luxury Market Africa 2023

Luxity’s State of The Luxury Market Africa 2022

Luxity’s State of The Luxury Market Africa 2021

Luxity’s State of The Luxury Market Africa 2020

Luxity’s State of The Luxury Market Africa 2019

However, despite the growth in demand and buying power, luxury brands have not made much progress or effort in establishing themselves in even the most prominent markets in Africa. While you can find luxury brands like Louis Vuitton and Gucci in South Africa and Morocco, many other designers are yet to make the investment into creating access to their items in Africa.

This has opened doors for businesses providing consumers with a modern online shopping experience and access to pre-owned designer items from around the world available in one place.

Popular Luxury Brands in Africa

As an industry leader that specialises in buying and selling pre-owned designer items, our online website and brick and mortar store in Melrose Arch, Johannesburg are a prime example of how the high the demand for luxury items in Africa is.

We have found through our data that the most popular brand for both men and women in Africa is Louis Vuitton, however, Chanel comes at a close second for women.

Overall, the top 3 most desired brands are Louis Vuitton, Chanel and Hermès. Specific items like the LV Neverfull, the Chanel Boy or Classic Flap bag and the Hermès Birkin or Kelly are a constant on the brands waiting list which easily spans 100’s of customers.

Through our market research, we found that the demand for designer handbags and shoes is very high in the luxury sphere.

Designer Brands Resale Value

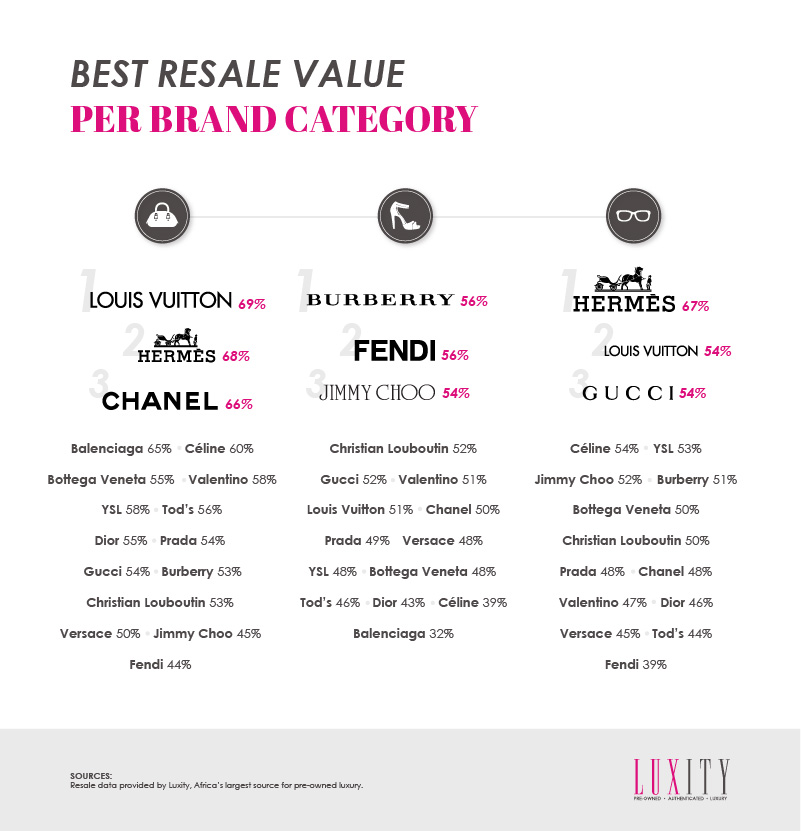

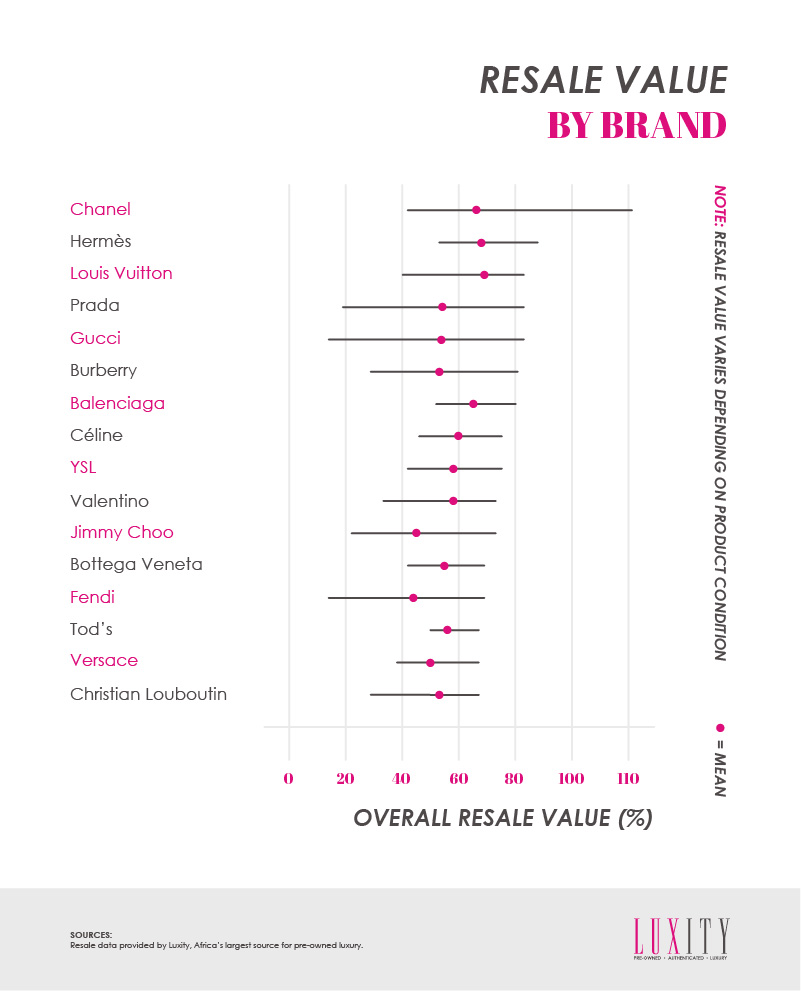

Louis Vuitton, Hermes and Chanel constantly find themselves at the forefront of the most popular handbag brands. These brands hold a resale value above 65%. While in the designer shoe section, Burberry, Fendi and Jimmy Choo take the lead, all three retaining over 50% of their retail value.

The high demand for luxury items in Africa can also be attributed to the fact that people realise that a smart designer purchase could hold investment value depending on how well they look after the item.

Chanel Return On Investment

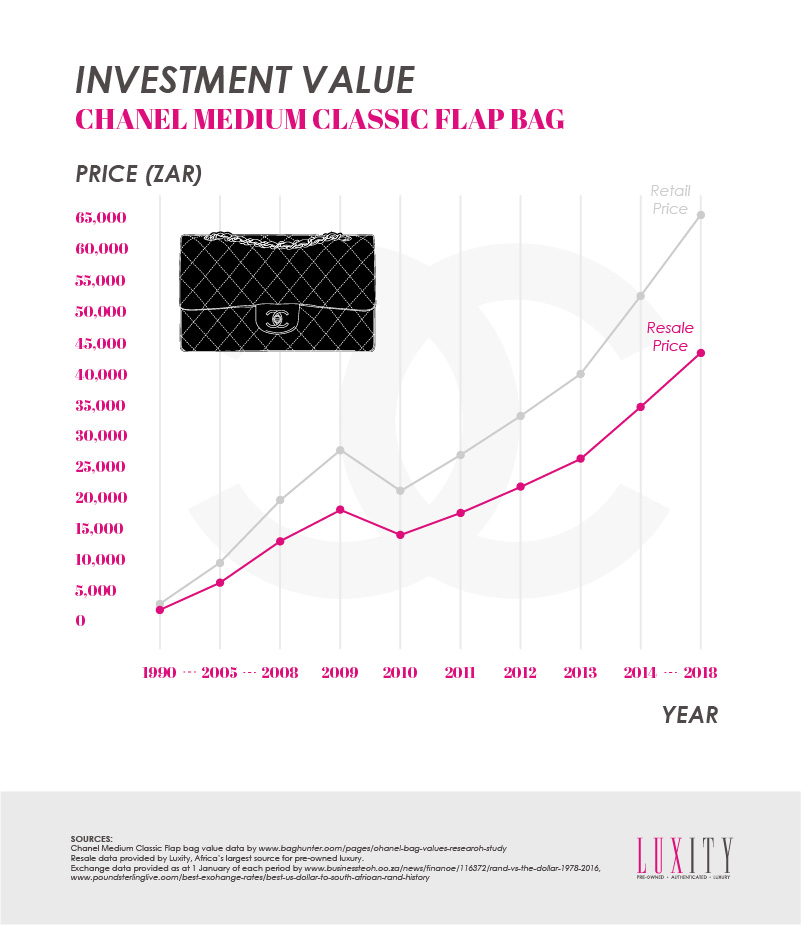

A great example of this is the Chanel Medium Classic Flap bag. If you had to purchase a Classic Flap bag in 1990 it would have cost you R3000.00 (considering the $/Rand exchange rate at the time). The design of the Classic Flap Bag has remained unchanged over the years, while inflation and the exchange rate have increased the retail price of the bag. Because of this, a brand-new Medium Flap Bag (identical to the one you purchased in 1990) would now cost you over R65,000.00. Therefore, if your bag purchased in 1990 for R3000.00 was still in impeccable condition, you could re-sell your bag for over R40,000.00 today.

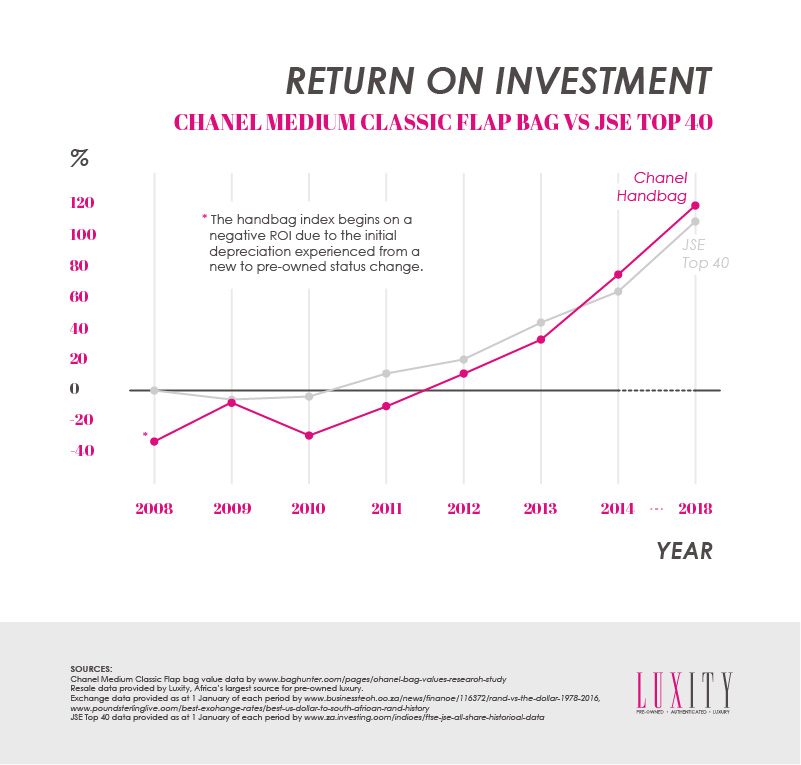

With a profit margin like that, the growth in the price of the Chanel Flap Bag competes very strongly against the growth of the stock market index. To put this into perspective, if you were to purchase a Flap Bag in 2008 and invest the same amount in the JSE Top 40 stock market, 10 years later, your stock index investment would have achieved a 109% growth, while your pristine condition Chanel Flap Bag will have seen a return of 119%.

Furthermore, our data has found that many other designer brands also have a high resale value which allows many Africans to securely sell their items that they may have purchased overseas or acquired and never really used over the years. Having access to a safe and reliable selling portal also provides them with an opportunity to freshen up their designer wardrobe more often.

Brands like Hermes, Louis Vuitton, Chanel and Balenciaga could get you up to 60% of the original value. While designer brands like Prada, Gucci, Burberry and Christian Louboutin can also retain over 50% of their original retail value. Re-sale value is also highly dependent on the condition in which the designer has been kept in, popularity and whether the item was a highly coveted limited edition that sold out.

The truth of the matter remains that the demand for luxury brands is rapidly growing in Africa as Africans become more aware of designer labels through travel, growth in wealth and easy access to information via social media. As more designer brands make their way to the continent, the faster the demand for selling and buying pre-owned designer items grows.

It’s going to be interesting to see which designer brands enter the African market next and who are the pioneers who will venture their way to Central Africa!

[products category=”handbags” cat_operator=”AND” columns= “3” Limit=”6″ order=”Desc” orderby=”date”]