Africa’s Luxury Shift 2025: Why Bags, Watches & Jewellery Are the Real Investments

This is your snapshot of how luxury is evolving across the continent. Pre-owned luxury is surging, with Luxity’s sales climbing nearly 28% year-on-year and an astounding 594% growth since 2019. Shoppers aren’t buying more — they’re buying smarter. The key? A focused investment on bags, watches, and jewellery — categories that combine emotional resonance with lasting financial value. Luxury didn’t slow down. It matured.

Why Bags, Watches & Jewellery Are Winning

1.Bags: The Most Powerful Luxury Asset

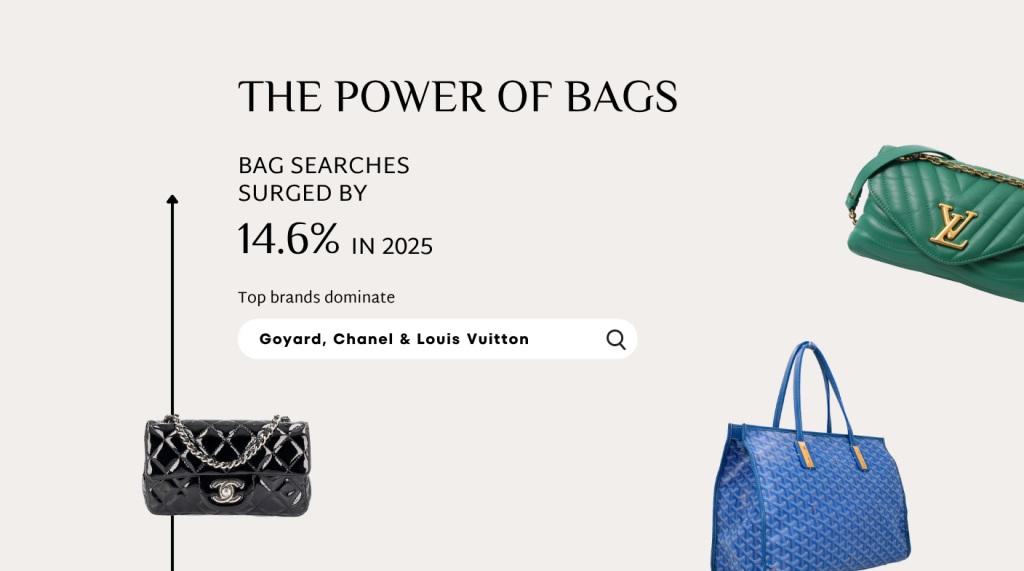

Search interest grew 14.6%, with bags claiming 21.59% of all luxury searches.

Top performers by value retention:

Goyard – 73.3%

Chanel – 72.3%

Louis Vuitton – 70.6%

Bags aren’t just style statements — they’re portable investment pieces.

2.Jewellery: 2025’s Breakout Category

Searches jumped +43.8%, fuelled by emotional value + strong resale.

Top brands by value retention:

Van Cleef & Arpels – 79.2%

Cartier – 76.7%

Hermès – 71.9%

Jewellery has become: inflation-resistant, generational, and instantly liquid.

3.Watches: The Most Reliable Investment Class

Rolex hit a historic average of 126.5% of retail value on resale.

Other strong performers:

Panerai – 79.2%

Hublot – 74.3%

Collectors are choosing heritage, value floors, and long-term appreciation — not hype.

The Rise of the Rational Collector

2025 marked a clear turn: South Africans are choosing longevity over loud logos.

They want: craftsmanship, liquidity, strong resale floors and iconic heritage -This is why maisons like Cartier, Hermès, Bulgari and Montblanc gained momentum, while hype-driven brands cooled.

Popularity ≠ Investment Value

Search popularity and resale value showed a weak correlation.The brands people Google most aren’t always the ones that hold value best. Consistency, heritage, and craftsmanship still win.

The 2026 Outlook: Luxury With Purpose

Luxury shoppers are more informed, intentional, and investment-led than ever.

The winners going forward: categories with proven value, brands with heritage and items that act like assets. South Africans aren’t scaling back. They’re upgrading strategically.

Conclusion

The future of African luxury won’t be driven by impulse or trend cycles. It’ll be driven by insight. Bags, watches and jewellery are no longer mere accessories, they’re cultural currency and wealth storage. Luxury in Africa isn’t slowing down. It’s getting smarter.